Fannie Mae

According to the “Washington Post,” Fannie Mae raised its minimum credit score for conventional loans in 2009 from 580 to 620. Even if you have a 20-percent down payment, you can be rejected if your score is below 620. Fannie Mae will also reject a loan if more than 45 percent of your income goes toward paying debt.

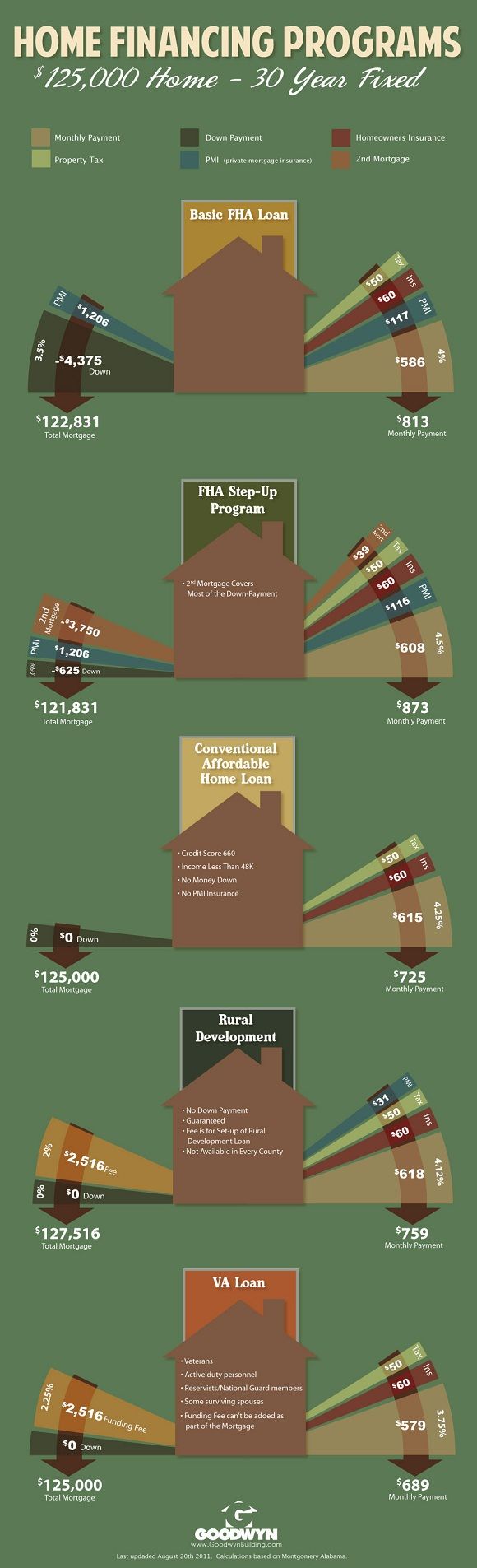

Government-Backed Loans

FHA recently changed its minimum credit score to 580, which qualifies you for lending programs that require only a 3.5 percent down payment.

VA loans are 100-percent financed and set aside for active and retired military, along with their families. There is no minimum credit score to qualify, though a better credit score will get you a better interest rate. Typically to get approved on A VA loan, you will need a 620 mid score with no bankruptcies or foreclosures in last 2 years with clean credit since BK or Foreclosures.

The better your score, the better your interest rate is likely to be. If your score is between 620 and 639—considered a risky score by some creditors—you could pay an interest rate of 5.718 percent on a $300,000, 30-year conventional mortgage. As of mid-August, 2010, If your score is at the high end, 760 to 850, your interest rate could be 4.129 percent on the same loan. A score of 650 may net you a rate of 5.172 percent.

USDA Home Loan Debt Ratio Waivers will be considered when the borrower has amiddle credit score of 660 or higher, and the co-borrower has a credit score of at least 620.

If borrowers have credit scores of 659 or below, additional compensating factors will need to be documented for the USDA Home Loan Underwriters.

Senior Loan Officer

phone: (502) 905-3708

Tuesday, June 21, 2011

Fico Score for Kentucky Mortgage

750 to 850 – Excellent

660 to 749 – Good

620 to 659 – Fair

350 to 619 – Poor

How is the FICO score rating determined? As a general rule, following factors help determine your FICO score:

35%, punctuality of payment in the past (only includes payments later than 30 days past due)

30%, the amount of debt, expressed as the ratio of current revolving debt (credit card balances, etc.) to total available revolving credit (credit limits)

15%, length of credit history

10%, types of credit used

10%, recent search for credit and/or amount of credit obtained recently

How to Improve Your FICO Score / Rating?

The following tips are recommended by FICO and credit reporting agencies to improve your FICO score and credit rating:

The most obvious tip: Pay your bills on time. Delinquent payments and collections can have a significantly negative impact on your FICO score.

If you have missed payments, get current and stay current.

Pay off debt rather than move it around.

Re-establish your credit history if you have had problems. Opening new accounts responsibly and paying them off on time may help in the long term. Opening a “secured” credit card (when your credit card limit is matched with a savings account with the lender/bank for the same amount) can help rebuild your credit.

Keep credit cards but manage them responsibly. In general, having credit cards and installment loans (and makingg timely payments) may help in the long term. Consumers with no credit cards, as an example, can be thought of by lenders as a higher risk than someone who has managed credit cards responsibly.

If you are having trouble paying your creditors, contact them to work out a payment schedule or contact a reputable credit counselor.

Keep credit card and revolving credit balances low.

Apply for and open new credit cards, loans, revolving accounts only as needed.

FICO Score / Rating Resources

The best resource in finding out your current score is the myfico website. For a fee, you can order a report that is compiled from the 3 major credit reporting agencies and will outline your FICO score.

Suze Orman also offers a FICO kit on her website, suzeorman.com, which is also available via the myfico website. Suze’s website also has excellent info about improving your FICO score and your credit.

Related articles

- Bucks: A Free FICO Score With Your Credit Card (bucks.blogs.nytimes.com)

- Tips for a Better FICO Score (louisvillekentuckymortgagerates.com)

- Understanding The Basics (ericnmws.com)

- Do Your Credit Reports Contain These Three Red Flags? (dailyfinance.com)

This excellent website definitely has all of the information and facts I wanted concerning this subject and didn’t know who to ask.

LikeLike

hey there and thank you for your info – I have definitely picked

up something new from right here. I did however expertise several technical points using this website, as I experienced to reload the site lots of times previous to I could get it to load properly.

I had been wondering if your web hosting is OK? Not that I’m complaining, but slow loading instances times will sometimes affect your placement in google and can damage your high-quality score if ads and marketing with Adwords. Well I’m adding this RSS to my

e-mail and could look out for a lot more of your respective exciting content.

Ensure that you update this again soon.

LikeLike

Reblogged this on Kentucky First Time Home Buyer Programs for 2014 FHA, VA, KHC, USDA, RHS, Fannie Mae Loans in Kentucky and commented:

Credit Scores Needed to qualify for a Ky Mortgage

LikeLike

It’s best to take part in a contest for one of the best blogs on the web. I’ll advocate this web site!

LikeLike