The title report which is also known as the Preliminary Title contains several schedules and these schedules can differ depending on the state where the property is located. The title usually begins with a “Schedule A”. This schedule indicates the property being insured, the legal description of the property being insured, the insured, the amount of insurance for the mortgagee and the fee owner. If there is leasehold then there would be Leasehold policy.

Schedule B indicates the history of the property also known as the chain of title. The report also indicates the survey boundaries, tax history and indicates if there are any open taxes, judgments, liens, easements of record and any or all clouds on the title.

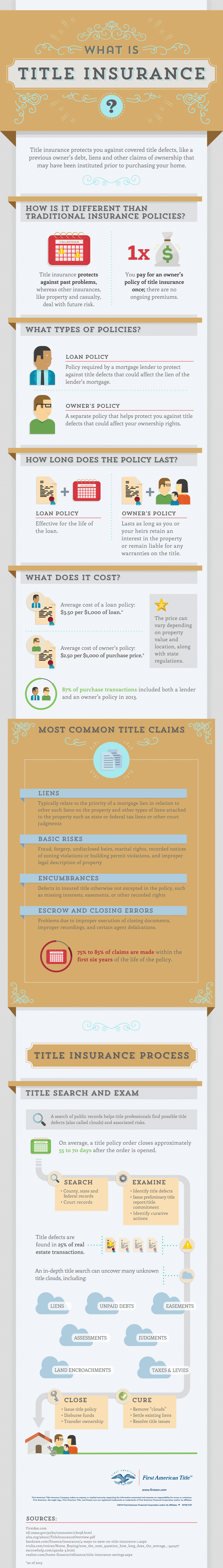

What is Title Insurance?

Title insurance protects the insured from claims regarding ownership of the property, liens against the property, and marketability of title to the property. The Rounsavall Title Group, in its capacity as an agent of Stewart Title Guaranty Company, offers two types of policies: the mortgagee policy which protects the lender, and the owner’s policy which protects the buyer.

According to the mortgagee policy, when a claim results in a total loss of title, the title insurance company shall take all steps necessary to defend the claim on behalf of the insured entity. In other words, the lender could ultimately be compensated for any loss they might suffer as a result of a title claim, for a claim could negatively impact their collateral interest in the property. Almost every lender today requires that you purchase this policy on their behalf at the closing of the loan. Keep in mind that this lender’s policy only protects the lender, and does not afford any protection to the home owner. So in the event of a claim, an uninsured home owner would still be responsible for repaying the debt to the lender despite the fact that they may no longer actually own the property. Furthermore, the uninsured home owner could lose any and all of the equity they have established in their home.

As such, we strongly recommend that every home owner obtain an owner’s title insurance policy in order to be fully protected in the event of a claim. It insures against the loss they may suffer, and typically includes reimbursement to the home owner for court costs and fees associated with the claim. Unlike other insurance policies you might get, this is a one time premium, and once purchased, is effective for the rest of the home owner’s life.

Related Articles

- Title Insurance (frontierbros.wordpress.com)

- Why should I get a title insurance? (nathanwoo1016.wordpress.com)

- Why You Need Title Insurance (ruthzeiss.wordpress.com)

- Title Insurance: Who Needs It? (frontierbros.wordpress.com)

- Jones Named Senior Underwriter for Stewart Title Guaranty Company (dailyfinance.com)

- It’s All In Your TITLE (cleartitleaz.wordpress.com)

- What homebuyers need to know about title insurance (traditionta.wordpress.com)

- Title Insurance…unsure if you need it? (nkyrealtoramy.wordpress.com)

- Florida Law Firm Kaye Law Offices, P.A. Releases “Title Insurance Calculator” iPhone App (virtual-strategy.com)

- Family: Title insurance saved our home (kshb.com)

Joel Lobb (NMLS#57916)

Senior Loan Officer

Text/call 502-905-3708

kentuckyloan@gmail.com

, NMLS ID# 57916, (www.nmlsconsumeraccess.org). I lend in the following states: Kentucky

Reblogged this on Kentucky USDA RHS Rural Housing Mortgage Loans and commented:

Business, closing attorney, home loan ky, Insurance, Insurance policy, Kentucky, KYinsurance policiesinsuredchain of titlehome ownerLeaseholdLoan OfficerHurstbournelegal descriptionproperty, Legal, louisville ky mortgage, louisville mortgage, Mortgage, Real Estate, real estate kentucky, Stewart

LikeLike

Business, closing attorney, home loan ky, Insurance, Insurance policy, Kentucky, KYinsurance policiesinsuredchain of titlehome ownerLeaseholdLoan OfficerHurstbournelegal descriptionproperty, Legal, louisville ky mortgage, louisville mortgage, Mortgage, Real Estate, real estate kentucky, Stewart

LikeLike

Title Insurance Information for Kentucky Mortgage Loans home mortgages. What is Title Insurance? Owners title insurance and Lender title insurance differences?

LikeLike