Users with Visual Disabilities

Images on this website are accompanied by alternative text describing graphics.

Documents on website may occasionally be presented in formats other than HTML. These formats are generally accessible to users using screen reading software. The screen reading capabilities of Adobe Acrobat Reader (full version) will allow vision impaired visitors to access PDF content.

If you have any difficulty viewing any page with adaptive technology, please let us know.

Additional Accommodations

The Commonwealth of Kentucky provides, upon request, reasonable accommodations including auxiliary aids and services necessary to afford an individual with a disability an equal opportunity to participate in all services, programs and activities. To request materials in an alternative format, each agency web site provides information for contacting the person or persons responsible for providing the service within the agency. Persons with hearing and speech impairments can contact each agency by using the Kentucky Relay Service, a toll-free telecommunication device for the deaf (TDD). For voice to TDD, call 800-648-6057. For TDD to voice, call 800-648-6056

Louisville Kentucky Mortgage Loans

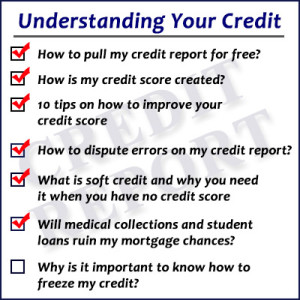

What Credit Score do You Need to qualify for a FHA VA KHC Kentucky Mortgage What Credit Score do You Need to Buy a Kentucky Home? When it comes to mortgages and credit scores, there are two really…

What Credit Score do You Need to qualify for a FHA VA KHC Kentucky Mortgage What Credit Score do You Need to Buy a Kentucky Home? When it comes to mortgages and credit scores, there are two really…

If you apply for credit and are denied, you have the right to obtain a free copy of the credit report the creditor used when denying your application. You should obtain a copy of the credit report to make sure that it is accurate. If you find inaccuracies, you should file a dispute with that credit bureau. Here are the phone numbers and websites of the three major credit bureaus:

Experian-1-888-397-3742

http://www.experian.com External Link

TransUnion-1-800-916-8800

http://www.transunion.com External Link

Equifax-1-800-685-1111

http://www.equifax.com External Link

LikeLike

Here are some important tips to increase your credit score:

.

Pay your bills on time. Late payments can hurt your score significantly. If you have missed payments, get current and stay current. The more you pay your bills on time, the better your score.

Keep credit card balances low relative to credit limits (30 percent or lower is recommended). “Maxing out” your credit cards means you have a very high utilization rate, which significantly lowers your credit score.

Pay off debt rather than moving it around.

Open new credit accounts only as needed; new accounts decrease the average age of your total accounts. Having accounts that have been opened a long time increases your credit score.

Avoid closing credit card accounts because this also decreases the average age of your accounts.

Apply for installment loans (mortgages, car loans, etc.) within a 30-day period because most credit scoring models will count multiple inquiries within a short period of time as only one inquiry.

LikeLike