appraisal flipping, fha appraisals, property flipping fha, property flipping va, property usda flipping, rhs appraisals, usda appraisals.

Kentucky FHA Appraisal Requirements For A Mortgage Loan Approval.

- Ordered through a third party source. Interested/vested parties may not initiate the appraisal. I.E> buyers, sellers, realtors, loan officer, family members

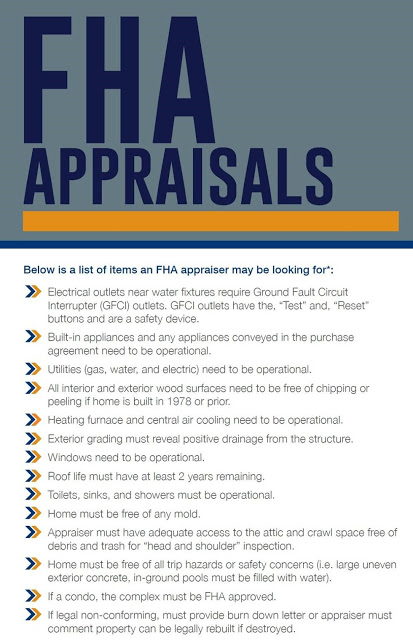

- Property must meet HUD’s minimum property standards. i.e.: permanent heat source, utilities must be on and in working order at time of inspection

- Flips < 90 days – not allowed Per HUD -If current owner owned less than 90 days FHA will not insure. Sometimes a second appraisal will be required by FHA investor if sold within the last 6 months for a large profit. Receipts of work done may be needed to substantiate increase in value of home in short-time period.

- Transferred appraisal – ok

- Appraisal valid 120 days – 30 day extension possible*

- Property eligibility – No location restrictions.

- New Construction Available

FHA MORTGAGE LOANS AND FLIPPING RULE FOR APPRAISALS

Resales Occurring 90 Days or Fewer after Acquisition:

View original post 422 more words