What Paperwork Will I Need?

Minimum Documentation List

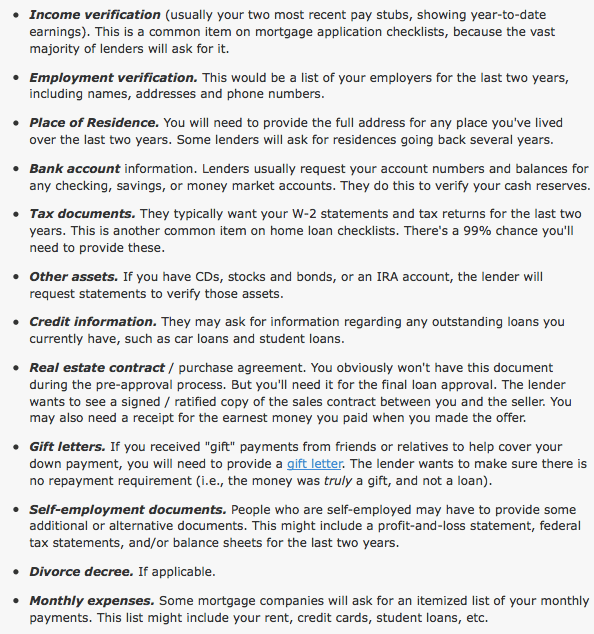

- Last 30 days pay stubs for all borrowers

- Last 2 years w2 statement for all borrowers

- Last 2 years tax returns, all schedules

- Minimum: Verbal of source cash to close will come from (assets, gift, equity)

Additional Documentation – Verbal of balances ok to start

- Last 60 days bank statements covering funds to close

- 401k documentation if taking out loan against retirement

Complete Documentation List for Most – Will eventually be needed

- Borrower’s Authorization form

- Current Driver’s License for all borrowers

- Social Security Card for all borrowers

- 4506T Form signed – Authorization to order tax transcripts for income verification

Self Employed, Bankruptcy, Foreclosure, Short Sale or Deed in Lieu in Past

If you are self employed, or suffered a financial hardship in the past, expect that additional documentation will be asked for.

Self Employed

- Evidence of 2 years as business entity (business license)

- Last 2 years business tax returns or Schedule C – if applicable

Financial Hardship

- Bankruptcy petition – if applicable

- Bankruptcy discharge – if applicable

- Bankruptcy notice to creditors – if applicable

- Final HUD from short sale – if applicable

- Deed in Lieu agreement – if applicable

- Addresses of homes included in BK – subsequent foreclosure, short sale or DIL

Your employment history is another major factor when it comes to your mortgage application. In general, most lenders want to see at least two years of consistent of employment history at the time you apply for your mortgage.

Requirements may differ depending on whether you are paid a salary versus hourly wages, work part-time versus full-time, and whether you are employed or self-employed. Note, too, that different lenders may handle income from things like a second job and overtime differently; these sources of income may not always be allowed to count toward your overall income on your mortgage application. Given these variables, you should be sure to tell potential lenders the details of your employment situation at the outset to make sure you don’t hit any unforeseen bumps in the road.

If, after approaching a handful of lenders, you find that your employment history is a little too spotty, now may be the time to focus on remaining consistently employed for a year or two before applying for a mortgage.

Get a pre-approval

Mortgage pre-approvals aren’t ironclad, but they are a solid indicator of an eventual approval so long as nothing major changes between pre-approval and final mortgage application. “I have seen people that have wanted to switch jobs or make major financial decisions in the middle of their application process,” says CORE New York real estate broker John Harrison. “Don’t do it. Every type of approval down to the final loan commitment is still usually contingent on something. If you change the scenario, you may pull the plug on the whole deal.”

—

Mortgage Loan Officer

Text/call: 502-905-3708

email: kentuckyloan@gmail.com

Reblogged this on Kentucky FHA Mortgage Loans Guidelines and commented:

Documents needed for Kentucky Mortgage Loan Approval, documents needed for loan pre-approval, FHA Loan Checklist for Approval, Kentucky Mortgage Approval

LikeLike