Debt-to-Income Ratio for Kentucky Mortgage Loans

Your debt-to-income ratio, technically speaking, is all of your monthly debt payments divided by your gross monthly income—that is, the percentage of your gross monthly income that goes towards payments for rent, mortgage, credit cards, and other debt. This is how lenders measure your ability to manage the monthly mortgage payments to repay the money you’ll be borrowing.

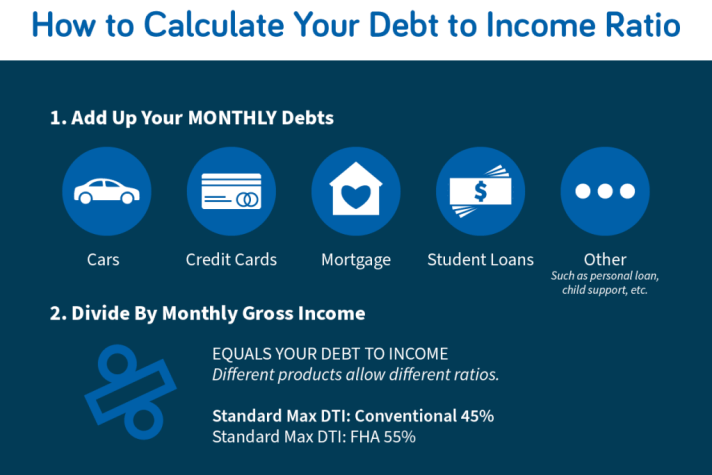

To calculate your debt-to-income ratio, add up your monthly debts—this includes car payments, credit cards, mortgages, and student loans. Divide this amount by your monthly gross income, and you’ll get your DTI ratio.

For reference, the standard maximum DTI for conventional loans is 45%, and for FHA loans it’s 55%. Of course, the maximum DTI depends on the home loan.

Joel Lobb

Mortgage Loan Officer

Individual NMLS ID #57916

American Mortgage Solutions, Inc.

10602 Timberwood Circle Louisville, KY 40223

Company NMLS ID #1364

click here for directions to…

View original post 20 more words