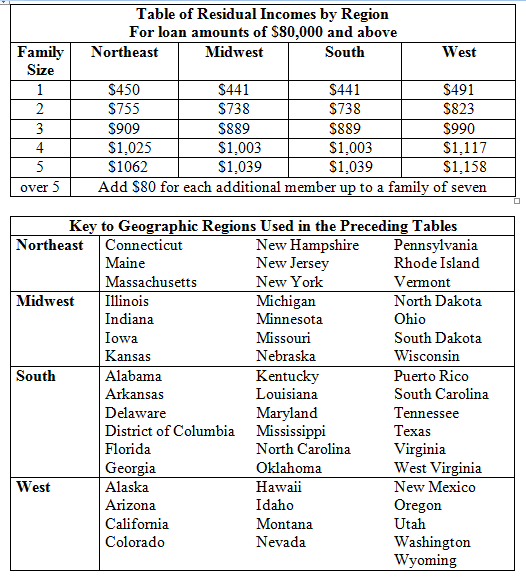

Residual Income for a Kentucky VA Home

Calculating Residual Income:

▪ Calculate the total gross monthly income of all occupying borrowers

▪ Deduct from gross monthly income the following items:

▫ State income taxes ▫ Proposed total monthly fixed payment (i.e. PITIA + MIP)

▫ Federal income taxes ▫ Estimated maintenance and utilities

▫ Municipal or other income taxes ▫ Job related expenses (e.g. childcare)

▫ Retirement or Social Security ▫ Gross upp of any Non-Taxable Income

▪ Subtract the sum of the deductions from the table above from the total gross monthly income of all members of the household of the occupying borrowers

▪ The balance is residual income

Calculating Gross Monthly Income:

▪ Gross monthly income should be calculated only for the occupying borrowers consistent with the requirements of HUD Handbook.

▪ Do not include bonus, part-time or seasonal income that does not meet the requirements for effective income as stated in HUD Handbook.

▪…

View original post 214 more words

2 thoughts on “How to Calculate Residual Income for a Kentucky VA Home Loan Approval”

Comments are closed.