Manufactured Home Options for Kentucky Homebuyers

Several manufactured homes for Kentucky conventional, FHA, VA and USDA programs.

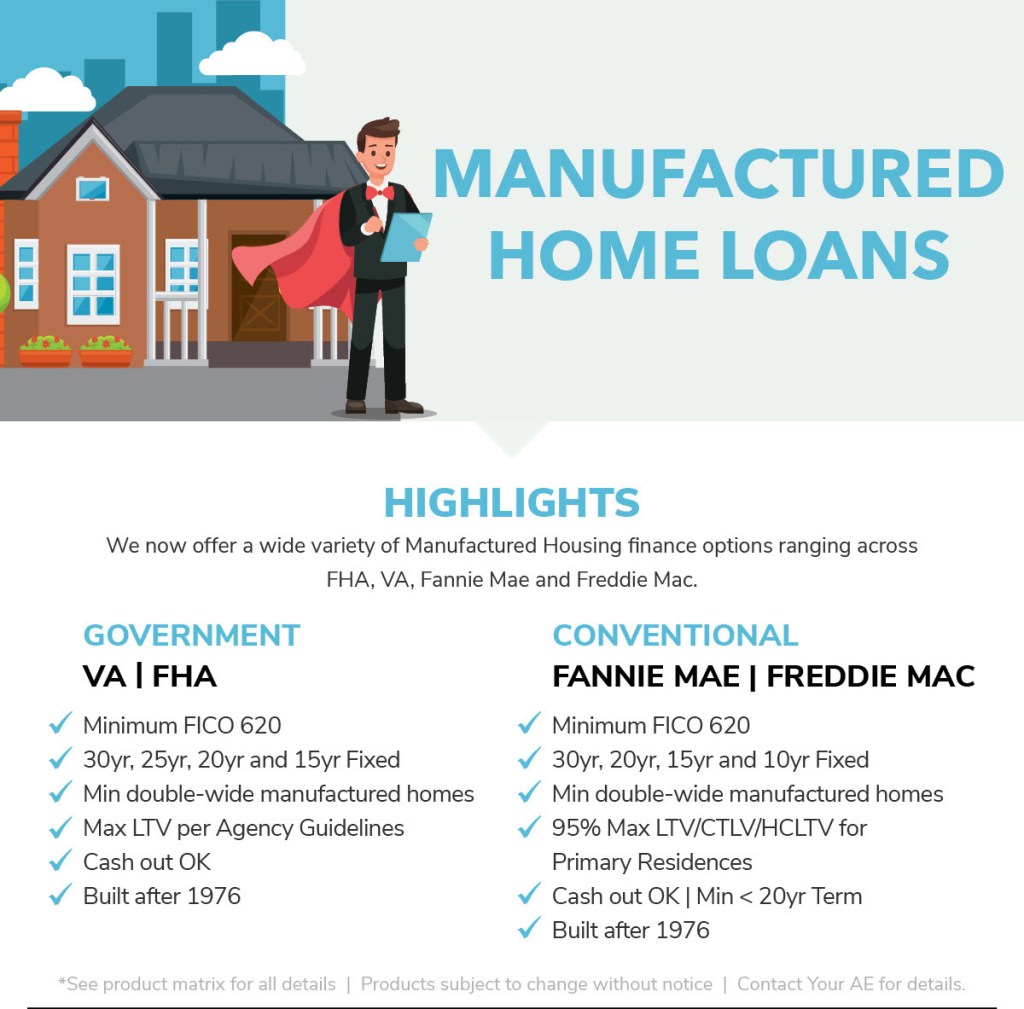

Kentucky Conventional Mobile Home Loans

- Up to 95 LTV on purchases

- 97 LTV Rate and Term REFI options for with an existing Fannie Mae loan through MH Advantage

- Purchase and rate and term options available for single wide, double wide and larger

- Cash-out options available for double-wide and larger

- Second home options available for double-wide and larger

- Down to 580 FICO

Kentucky FHA Mobile Home Loans

- Up to 96.5 LTV on purchases and 97.75 LTV on Rate and Term REFIs

- Cash-out REFI options up to 80 LTV

- Purchase, cash-out and Rate and Term REFI options available for single wide, double wide and larger

- Down to 550 FICO

- Manual underwrite options available

- Manufactured homes are now available on FHA 203(k) products!

Kentucky VA Mobile Home Loans

- Up to 100 LTV on purchases and Rate and Term REFIs

- Up to 105 LTV for streamlined IRRRLs

- Cash-out REFI options up to 90 LTV

- Cash-out REFI options up to 80 LTV

- Down to 550 FICO

- Manual underwrite options available

Kentucky USDA Mobile Home Loans

- Up to 100 LTV on purchases and Rate and Term REFIs

- Purchase and Rate and Term REFI options available for single wide, double wide and larger

- Down to 580 FICO

- Manual underwrite options available

One thought on “Manufactured Home Guidelines for Kentucky FHA, Conventional and USDA, VA Mortgage Loans”

Comments are closed.