What kind of credit score do I need?

Most lenders want a 580 to 620 credit score nowadays with no bankruptcies in the last 2 years and no foreclosures in the last 3 years. You have three fico scores from Experian, Equifax and Transunion credit reporting agencies and the lenders will throw out the high and low score and take the middle score of the borrower(s).

Credit scores range from 334 to 850, the higher the score the better. The Fico Versions used for mortgage credit scores are Version, 2,4 and 5 models for Experian, Equifax and Transunion. They’re a lot of different scoring models out there and I can walk you through that once I pull your credit.

For example if you have a 598, 625, 604 on each of the main three reporting agencies, then your qualifying fico score would be 604.

They always take the lowest middle score of both borrowers, so keep that in mind too if there is a co-borrower. So if your mid score is 616, and your co-borrower is 638, and we used both of your incomes, then the score used to qualify would be the 616 score.

Once I get the credit report, I can analyze your scores, If the scores are okay, then we can proceed with pre-approval. If we need to work on them, I can help do that too.

If you’re trying to get a mortgage, your credit score matters. Mortgage lenders use credit scores — as well as other information — to assess your likelihood of repaying a loan on time.

Because credit scores are so important, lenders set minimum scores you must have in order to qualify for a mortgage with them. Minimum credit score varies by lender and mortgage type, but generally, a higher score means better loan terms for you.

Let’s look at which loan types are best for different credit scores.

Credit score needed to buy a house

Mortgage lending is risky, and lenders want a way to quantify that risk. They use your three-digit credit score to gauge the risk of loaning you money since your credit score helps predict your likelihood of paying back a loan on time. Lenders also consider other data, such as your income, employment, debts and assets to decide whether to offer you a loan.

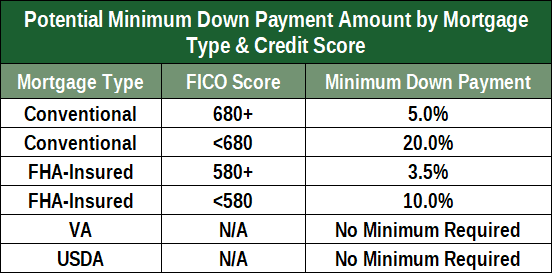

Different lenders and loan types have different borrower requirements, loan terms and minimum credit scores. Here are the requirements for some of the most common types of mortgages.

Conventional loan

Minimum credit score: 620

A conventional loan is a mortgage that isn’t backed by a federal agency. Most mortgage lenders offer conventional loans, and many lenders sell these loans to Fannie Mae or Freddie Mac — two government-sponsored enterprises. Conventional loans can have either fixed or adjustable rates, and terms ranging from 10 to 30 years.

You can get a conventional loan with a down payment as low as 3% of the home’s purchase price, so this type of loan makes sense if you don’t have enough for a traditional down payment. However, if your down payment is less than 20%, you’re required to pay for private mortgage insurance (PMI), which is an insurance policy designed to protect the lender if you stop making payments. You can ask your servicer to cancel PMI once the principal balance of your mortgage falls below 80% of the original value of your home.

FHA loan

Minimum credit score (10% down): 500

Minimum credit score (3.5% down): 580

FHA loans are backed by the Federal Housing Administration (FHA), a part of the U.S. Department of Housing and Urban Development (HUD). The FHA incentivizes lenders to make mortgage loans available to borrowers who might not otherwise qualify by guaranteeing the federal government will repay the mortgage if the borrower stops making payments. This makes an FHA loan a good option if you have a lower credit score.

FHA loans come in 15- or 30-year terms with fixed interest rates. Unlike conventional mortgages, which only require PMI for borrowers with less than 20% down, all FHA borrowers must pay an up-front mortgage insurance premium (MIP) and an annual MIP, as long as the loan is outstanding.

VA loan

Minimum credit score: N/A

VA loans are mortgages backed by the U.S. Department of Veterans Affairs (VA). The VA guarantees loans made by VA-approved lenders to qualifying veterans or service members of the U.S. armed forces, or their spouses. This type of loan is a great option for veterans and their spouses, especially if they don’t have the best credit and don’t have enough for a down payment.

VA loans are fixed-rate mortgages with 10-, 15-, 20- or 30-year terms.

Most VA loans don’t require a down payment or monthly mortgage insurance premiums. However, they do require a one-time VA funding fee, that ranges from 1.4% to 3.6% of the loan amount.

USDA loan

Minimum credit score: N/A

The U.S. Department of Agriculture guarantees loans for borrowers interested in buying homes in certain rural areas. USDA loans don’t require a minimum down payment, but you have to meet the USDA’s income eligibility limits, which vary by location.

All USDA mortgages have fixed interest rates and 30-year repayment terms.

USDA-approved lenders must pay an up-front guarantee fee of up to 3.5% of the purchase price to the USDA. That fee can be passed on to borrowers and financed into the home loan. If the home you want to buy is within an eligible rural area (defined by the USDA) and you meet the other requirements, this could be a great loan option for you.

What else do mortgage lenders consider?

Your credit score isn’t the only factor lenders consider when reviewing your loan application. Here are some of the other factors lenders use when deciding whether to give you a mortgage.

- Debt-to-income ratio — Your debt-to-income (DTI) ratio is the amount of debt payments you make each month (including your mortgage payments) relative to your gross monthly income. For example, if your mortgage payments, car loan and credit card payments add up to $1,800 per month and you have a $6,000 monthly income, your debt-to-income ratio would be $1,800/$6,000, or 30%. Most conventional mortgages require a DTI ratio no greater than 36%. However, you may be approved with a DTI up to 45% if you meet other requirements.

- Employment history — When you apply for a mortgage, lenders will ask for proof of employment — typically two years’ worth of W-2s and tax returns, as well as your two most recent pay stubs. Lenders prefer to work with people who have stable employment and consistent income.

- Down payment — Putting money down to buy a home gives you immediate equity in the home and helps to ensure the lender recoups their loss if you stop making payments and they need to foreclose on the home. Most loans — other than VA and USDA loans — require a down payment of at least 3%, although a higher down payment could help you qualify for a lower interest rate or make up for other less-than-ideal aspects of your mortgage application.

- The home’s value and condition — Lenders want to ensure the home collateralizing the loan is in good condition and worth what you’re paying for it. Typically, they’ll require an appraisal to determine the home’s value and may also require a home inspection to ensure there aren’t any unknown issues with the property.

How is your credit score calculated?

Most talk of credit scores makes it sound as if you have only one score. In fact, you have several credit scores, and they may be used by different lenders and for different purposes.

The three national credit bureaus — Experian, Equifax and TransUnion — collect information from banks, credit unions, lenders and public records to formulate your credit score. The most common and well-known scoring model is the FICO Score, which is based on the following five factors:

- Payment history (35%) — A history of late payments will drag your score down, as will negative information from bankruptcies, foreclosures, repossessions or accounts referred to collections.

- How much you owe (30%) — Your credit utilization ratio is the amount of revolving credit you’re using compared to your total available credit. For example, if you have one credit card with a $2,000 balance and a $4,000 credit limit, your credit utilization ratio is 50%. Credit scoring models view using a larger percentage of your available credit as risky behavior, so high balances and maxed-out credit cards will negatively impact your score.

- Length of credit history (15%) — This factor considers the age of your oldest account, newest account and the average age of all your credit accounts. In general, the longer you’ve been using credit responsibly, the higher your score will be.

- Types of accounts (10%) — Credit scoring models favor people who use a mix of credit cards, installment loans, mortgages and other types of credit.

- Recent credit history (10%) — Lenders view applying for and opening several new credit accounts within a short period as a sign of financial trouble and it’ll negatively impact your score.

What Fico Score is Used for a Mortgage Loan Approval

Which Lenders Use Which FICO Scores?

With the exception of the mortgage market, which is heavily regulated, lenders can generally choose which FICO score they use when doing a credit check. However, they tend to use certain versions depending on the kind of credit for which you’re applying. Here’s a look at the most common FICO scores used for each type of credit.

Mortgages

When you’re taking out a mortgage, there’s a good chance that the loan will end up being bought by Fannie Mae or Freddie Mac. As with many other aspects of the housing market, these massive government-backed mortgage companies dictate which FICO scores can be used by home lenders. Here are the FICO scores used in credit reports generated by the three credit bureaus (as well as the alternative names the bureaus use to advertise them):9

- Experian: FICO Score 2 (Experian/Fair Isaac Risk Model V2SM)

- Equifax: FICO Score 5 (Equifax Beacon 5.0)

- TransUnion: FICO Score 4 (TransUnion FICO Risk Score, Classic 04)

Why Do Mortgage Lenders Use Older FICO Scores?

The reason mortgage lenders use older FICO Scores is because they don’t have a choice. They are essentially forced to use them.

Unlike every other industry, mortgage lenders don’t have the flexibility to choose the scoring model brand or generation they want to use. Mortgage lenders must follow the direction of the government-sponsored enterprises (GSEs), Fannie Mae and Freddie Mac, as it pertains to scoring models.

The GSEs play an important role in mortgage lending. These publicly traded companies buy mortgages from banks, bundle them together, and sell them to investors. This frees up funds so that banks can offer new mortgages to additional homebuyers.

For a bank to sell a mortgage to Fannie Mae or Freddie Mac, the loan has to meet certain guidelines. Some of these guidelines require borrowers to have a minimum credit score under specific FICO Score generations.

If a lender uses a different scoring model other than what the GSEs approve when it underwrites a mortgage, it probably won’t be able to sell that mortgage after it issues the loan. This limits the lender’s ability to write new loans because it will have less money available to lend to future borrowers.

Ready to shop around for a mortgage?

Joel Lobb

Mortgage Loan Officer

Individual NMLS ID #57916

American Mortgage Solutions, Inc.

10602 Timberwood Circle

Louisville, KY 40223

Company NMLS ID #1364

Text/call: 502-905-3708

email: kentuckyloan@gmail.com

https://kentuckyloan.blogspot.com/

CONFIDENTIALITY NOTICE: This message is covered by the Electronic Communications Privacy Act, Title 18, United States Code, §§ 2510-2521. This e-mail and any attached files are deemed privileged and confidential, and are intended solely for the use of the individual(s) or entity to whom this e-mail is addressed. If you are not one of the named recipient(s) or believe that you have received this message in error, please delete this e-mail and any attached files from all locations in your computer, server, network, etc., and notify the sender IMMEDIATELY at 502-327-9770. Any other use, re-creation, dissemination, forwarding, or copying of this e-mail and any attached files is strictly prohibited and may be unlawful. Receipt by anyone other than the named recipient(s) is not a waiver of any attorney-client, work product, or other applicable privilege. E-mail is an informal method of communication and is subject to possible data corruption, either accidentally or intentionally. Therefore, it is normally inappropriate to rely on legal advice contained in an e-mail without obtaining further confirmation of said advice.

One thought on “What credit score do you need for a mortgage?”

Comments are closed.