Mortgage Loan in Kentucky After Bankruptcy or Foreclosure

Are you looking to buy a home in Kentucky but concerned about past credit issues such as bankruptcy or foreclosure? Many loan programs can help you get approved. This is true even with past derogatory credit and lower FICO scores. Here is essential information about the waiting periods for FHA, VA, USDA, and conventional loans in Kentucky. Learn about the specific requirements for each loan type.

Understanding Waiting Periods After Bankruptcy or Foreclosure when it comes to getting a mortgage loan again in Kentucky

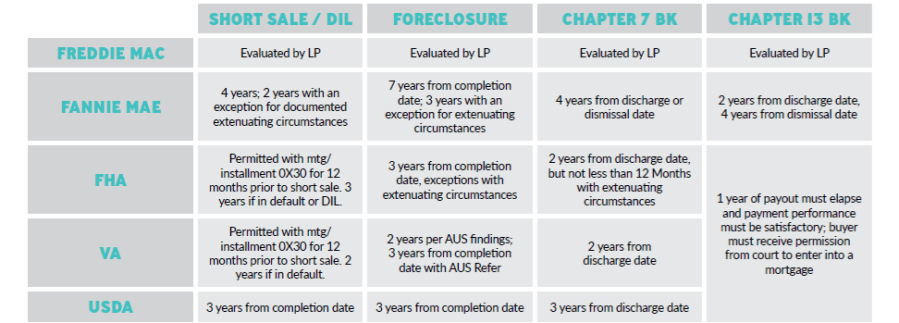

When applying for a mortgage after a bankruptcy or foreclosure, the waiting period varies based on the loan program. Here’s a breakdown:

1. Kentucky FHA Loans

Foreclosure: 3 years from the case assignment date .

Short Sale or Deed-in-Lieu: 3 years

Chapter 7 Bankruptcy: 2 years from the discharge date.

Chapter 13 Bankruptcy: 2 years from the case number assignment date.

2. Kentucky VA Loans (For Veterans and Active Duty Members of the Armed Forces)

Foreclosure: 2 years

Short Sale or Deed-in-Lieu: Same as foreclosure requirements.

Chapter 7 Bankruptcy: 2 years

Chapter 13 Bankruptcy: 1 year if the repayment period has elapsed.

3. Kentucky USDA Loans (For Rural Properties in Kentucky see map below)

Foreclosure: 3 years from the completion date.

Short Sale or Deed-in-Lieu: 3 years from the completion date.

Chapter 7 Bankruptcy: 3 years from the discharge date.

Chapter 13 Bankruptcy: 1 year if the repayment period has elapsed.

4. Kentucky Conventional Loans

Foreclosure: 7 years from the completion date.

Short Sale or Deed-in-Lieu: 4 years from the completion date.

Chapter 7 Bankruptcy: 4 years from discharge or dismissal.

Chapter 13 Bankruptcy: 2 years from discharge or 4 years from dismissal.

Conventional loans are more stringent with their requirements, but they can be a good option for borrowers with higher credit scores.

Frequently Asked Question on Kentucky Mortgages After Bankruptcy

📘Bankruptcy Mortgage Questions

📘 Chapter 13 Bankruptcy Mortgage Questions

How long after a Chapter 13 bankruptcy can I get a mortgage?

You may be eligible after 12 on-time payments during your repayment plan (with court approval), or immediately after discharge with FHA, VA, or Non-QM options.

What types of mortgage loans are available during or after Chapter 13?

FHA, VA, USDA, Conventional (after 2 years discharge), and Non-QM Portfolio Loans.

What is your waiting period for an FHA loan after bankruptcy?

FHA typically allows for approval during Chapter 13 (after 12 payments with approval) or immediately after discharge.

What kind of interest rate should I expect?

Rates depend on credit recovery and loan type. Expect slightly higher-than-average rates during early post-bankruptcy stages, with the potential for competitive terms.

What are the most common obstacles after discharge?

Low credit scores, high DTI ratios, limited assets, incomplete documentation, or lack of court approval.

How long does it take to refinance after Chapter 13 discharge?

Typically 2–4 weeks if all documents are ready.

How long does it take to purchase after Chapter 13 discharge?

Often 30–45 days from pre-approval to closing.

Can I purchase a home while still in Chapter 13?

Yes, with 12 months of on-time payments and court/trustee approval.

Can I refinance my mortgage during Chapter 13?

Yes, under certain conditions and with approval from the bankruptcy court.

How long does it take to get approved during a Chapter 13 payment plan?

Typically 45–60 days including court approval, but may vary by case and jurisdiction.

Can I do a cash-out refinance after Chapter 13?

Yes, usually available 6–12 months post-discharge if equity and credit conditions are favorable.

Are there any mortgage offer loans for homeowners who own their home outright after bankruptcy?

Yes. Rate-and-term and cash-out refinances may be available depending on credit and income.

Are there low down payment loan options post-Chapter 13?

Yes. FHA (3.5% down), VA (0% down), USDA (0% down), and KHC programs are available.

What credit score is needed after Chapter 13?

FHA 580 with 3.5% down FHA and 500+ score with 10% down payment, VA: no minimuim score but 620 preferred USDA: no minumum score but 640 preferred, Conventional: 620+, Non-QM: 500–550+

What if I don’t qualify right now?

You’ll receive a custom action plan to build credit, savings, or income toward qualification.

How do student loans affect mortgage eligibility after bankruptcy?

Student loans count toward your DTI. Deferred loans typically calculated at 0.5%–1% of the balance.

Where can I find forms to file for Chapter 13 Bankruptcy?

Forms are available via the U.S. Bankruptcy Court website or through a licensed bankruptcy attorney.

How does divorce affect my Chapter 13 plan?

Divorce can affect repayment and income stability. Plan modifications may be needed through court.

📙 Chapter 11 Bankruptcy Mortgage Questions

“`What mortgage options are available after Chapter 11 bankruptcy?

Loan types vary based on personal vs. business bankruptcy. FHA, VA, and Non-QM may apply post-discharge.

What if I don’t qualify today?

You’ll receive a recovery plan tailored to reestablish eligibility.

When can I apply for a loan post-Chapter 11?

After your plan is confirmed or the bankruptcy is discharged—typically 12–24 months depending on the loan.

📗 Chapter 7 Bankruptcy Mortgage Questions

“`How long must I wait after Chapter 7 to get a mortgage?

FHA/VA: 2 years, USDA: 3 years, Conventional: 4 years, Non-QM: as little as 1 day post-discharge.

What loan options are available post-Chapter 7?

FHA, VA, USDA, Conventional, and Non-QM—all with different credit and timeline requirements.

Are there extra fees for Chapter 7 borrowers?

No hidden fees. Standard lender fees apply. Review your Loan Estimate for details.

Do you offer loans for mobile homes on past Chapte7 or Chapter 13?

Yes—if the home is on a permanent foundation and meets agency/HUD guidelines.

Email – kentuckyloan@gmail.com

Call/Text – 502-905-3708

Joel Lobb

Mortgage Loan Officer – Expert on Kentucky Mortgage Loans

www.mylouisvillekentuckymortgage.com

Address: 911 Barret Ave., Louisville, KY 40204

Evo Mortgage

Company NMLS# 1738461

Personal NMLS# 57916

For assistance with Kentucky mortgage loans, reach out via email, call, or text Joel Lobb directly.

One thought on “Getting Approved for a Mortgage Loan in Kentucky After Bankruptcy or Foreclosure”

Comments are closed.