When buying a home in Kentucky, you need a solid fico credit score. It’s essential for qualifying for popular mortgage programs like FHA, VA, USDA, or KHC loans. Here are six actionable tips to improve your fico credit score. These tips will increase your chances of getting approved for your dream home loan.

1. Pay Your Monthly Bills on Time

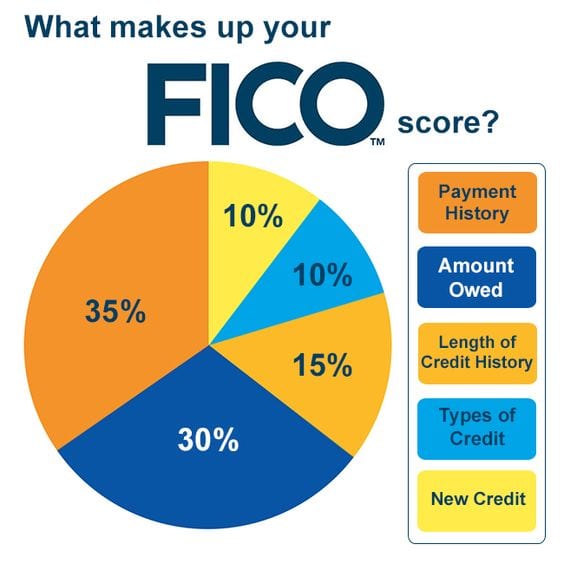

One crucial step for boosting your fico credit score is paying your bills on time. It is essential to pay them promptly. Your payment history makes up 35% of your FICO score. Missing payments significantly hurt your chances of loan approval. Set reminders, automate payments, or create a calendar to ensure you never miss a due date.

2. Lower Your Credit Card Balances

Credit utilization is the amount of available credit you’re using. It is a key factor in your credit score. Experts recommend keeping your credit utilization below 30%. To achieve this: Pay down high balances.

Avoid making new charges while focusing on reducing debt.

Stick to a budget to free up money for debt repayment.

Lowering your credit utilization can have a dramatic impact on your score, often within a few months.

3. Limit Credit Inquiries

Every time you apply for a new line of credit, it triggers a hard inquiry on your credit report. A hard inquiry can lower your score temporarily.

If you’re shopping for a mortgage, consolidate inquiries within a 14- to 45-day period. This way, they’re treated as a single inquiry.

Do not open unnecessary credit cards. Too many inquiries can hurt your chances of qualifying for an FHA, VA, USDA, or KHC loan.

Remember, new credit applications and inquiries account for 10% of your score.

4. Keep Old Credit Cards Open

Even if you don’t use an old credit card, keep it open. Closing a card reduces your available credit and can hurt your credit utilization ratio.

Use old cards for small purchases occasionally to keep them active.

Pay off balances in full to avoid interest charges.

This strategy helps maintain your credit history length, which impacts your score.

5. If your credit card balance is high compared to your credit limit, ask your bank to increase your limit.

This reduces your credit utilization ratio without requiring you to pay off debt immediately. However, avoid using the extra credit for new spending.

6. Address Late Payments Quickly

If you’ve missed a payment, act fast: Contact your lender or credit card issuer to negotiate. If you’ve had a good track record, they might not report the late payment to credit bureaus.

Pay the overdue amount as soon as possible to minimize damage to your score.

Late payments can remain on your credit report for up to seven years, but their impact lessens over time.

How Long Does Bad Credit Stay on Your Report?

2 years or less: Credit inquiries.

7 years or less: Late payments, collections, judgments, foreclosures, repossessions, and charge-offs.

10 years or less: Chapter 7 or Chapter 10 bankruptcies.

Indefinitely: Certain student loans and tax liens.

Why Your Credit Score Matters for Kentucky Mortgages

Lenders assess your credit score for Kentucky mortgage programs like FHA, VA, USDA, and KHC loans. They use it to evaluate your financial reliability. Here’s a quick rundown of the minimum credit scores for these programs:

When buying a home in Kentucky, understanding the credit score requirements for different mortgage programs is essential. Your credit score plays a crucial role in determining your eligibility and the loan options available to you. Here’s a breakdown of the minimum credit scores required for FHA, VA, USDA, Conventional, and KHC loans.

1. Conventional Loans

Minimum Credit Score Required: 620

Conventional loans are ideal for borrowers with strong credit. You need the ability to make at least a 3% down payment. These loans often have competitive interest rates and no upfront mortgage insurance premiums.

2. Jumbo Loans

Minimum Credit Score Required: 680

Jumbo loans are used for homes exceeding the conventional loan limit. These loans require higher credit scores and larger down payments, but they’re great for buying high-value properties in Kentucky.

3. FHA Loans

Minimum Credit Score Required:

500 (with a 10% down payment)

580 (with a 3.5% down payment)

FHA loans are perfect for first-time homebuyers or those with lower credit scores. Backed by the Federal Housing Administration, these loans offer flexible terms and lower interest rates.

4. VA Loans

Minimum Credit Score Required:

No official minimum, but most lenders prefer 620

VA loans are accessible to Kentucky veterans. They are also available to active-duty military members and eligible spouses. These loans feature no down payment and no private mortgage insurance (PMI), making them a top choice for veterans.

5. USDA Loans

Minimum Credit Score Required:

No official minimum, but most lenders prefer 640

USDA loans are for low- to moderate-income borrowers in rural Kentucky. These loans offer 100% financing and reduced mortgage insurance costs.

6. KHC (Kentucky Housing Corporation) Loans

Minimum Credit Score Required: 620 for Government FHA, VA, USDA and 660 for Conventional loans

KHC loans provide down payment assistance up to $10,000 to be used for down payment assistance,, closing costs and prepaids . 2nd mortgage for $10,000 over 10 years at 3.75% fixed rate

KHC is designed for first-time homebuyers in Kentucky. These programs work in conjunction with FHA, VA, and USDA loans, helping make homeownership more affordable.

1 – Email – kentuckyloan@gmail.com 2. Call/Text – 502-905-3708

Joel Lobb

Mortgage Loan Officer – Expert on Kentucky Mortgage Loans

Website: www.mylouisvillekentuckymortgage.com

Website: www.mylouisvillekentuckymortgage.com Address: 911 Barret Ave., Louisville, KY 40204

Address: 911 Barret Ave., Louisville, KY 40204

Evo Mortgage

Company NMLS# 1738461

Personal NMLS# 57916

For assistance with Kentucky mortgage loans, reach out via email, call, or text Joel Lobb directly.