Are you a first-time homebuyer in Kentucky looking to navigate the various loan programs available? Knowing the options and requirements for FHA, USDA, VA, Fannie Mae, and Kentucky Housing Down Payment Assistance Programs can help. This understanding can make your journey to home ownership smoother.

In this guide, we’ll explore each program’s down payment and credit score requirements. We will also look into the debt-to-income ratio and work history requirements. This will help you make informed decisions.

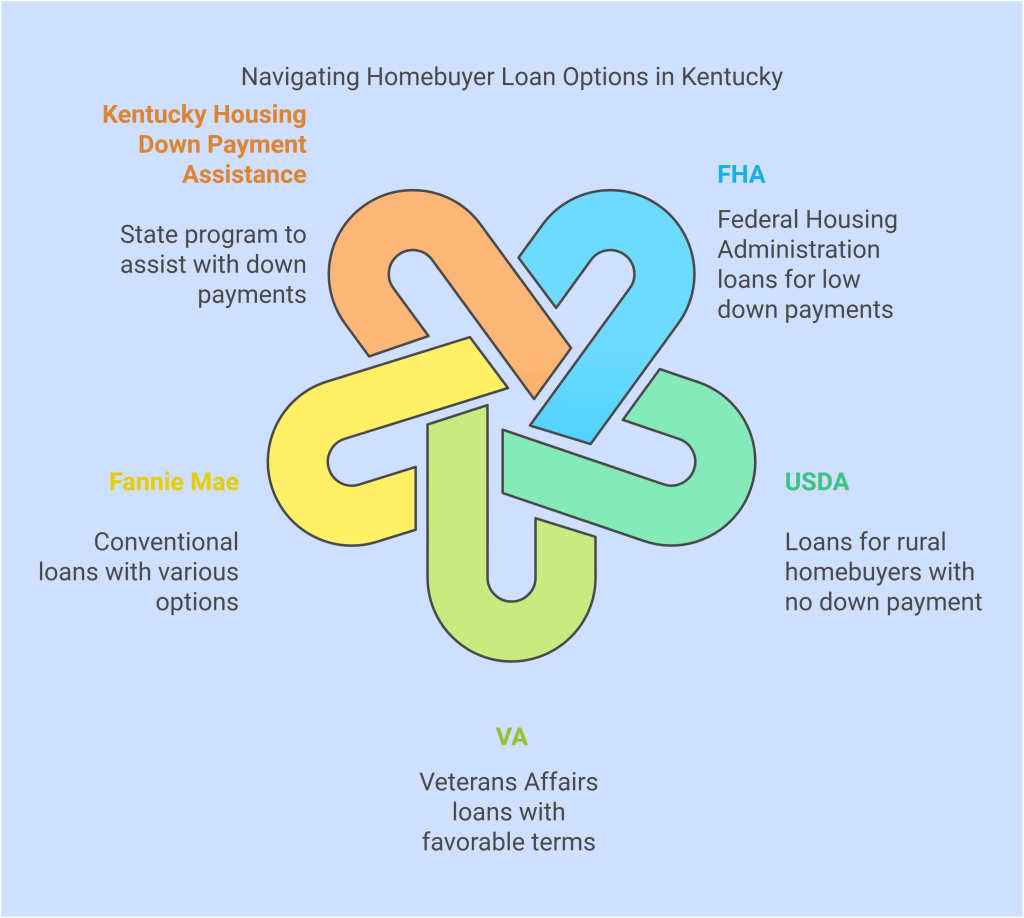

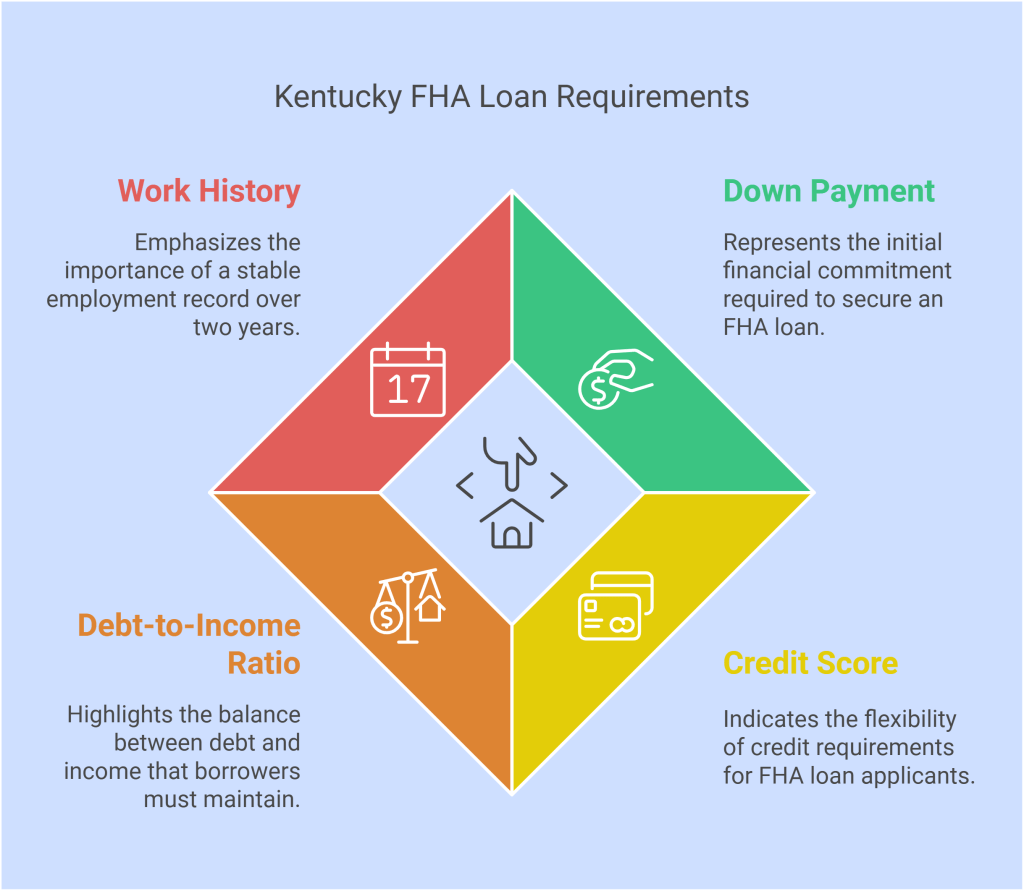

Kentucky FHA Loan Program

Down Payment: FHA loans typically require a minimum down payment of 3.5% of the purchase price.

Credit Score: FHA loans are more flexible with credit scores. Usually, a score of 500 to 580 is required, depending on the lender.

Debt-to-Income Ratio: Front-end DTI ratio should not exceed 45%, and back-end DTI ratio should not exceed 50 to 56.99%.

Work History:A two year table employment history with at least 2 years of consistent income is preferred.

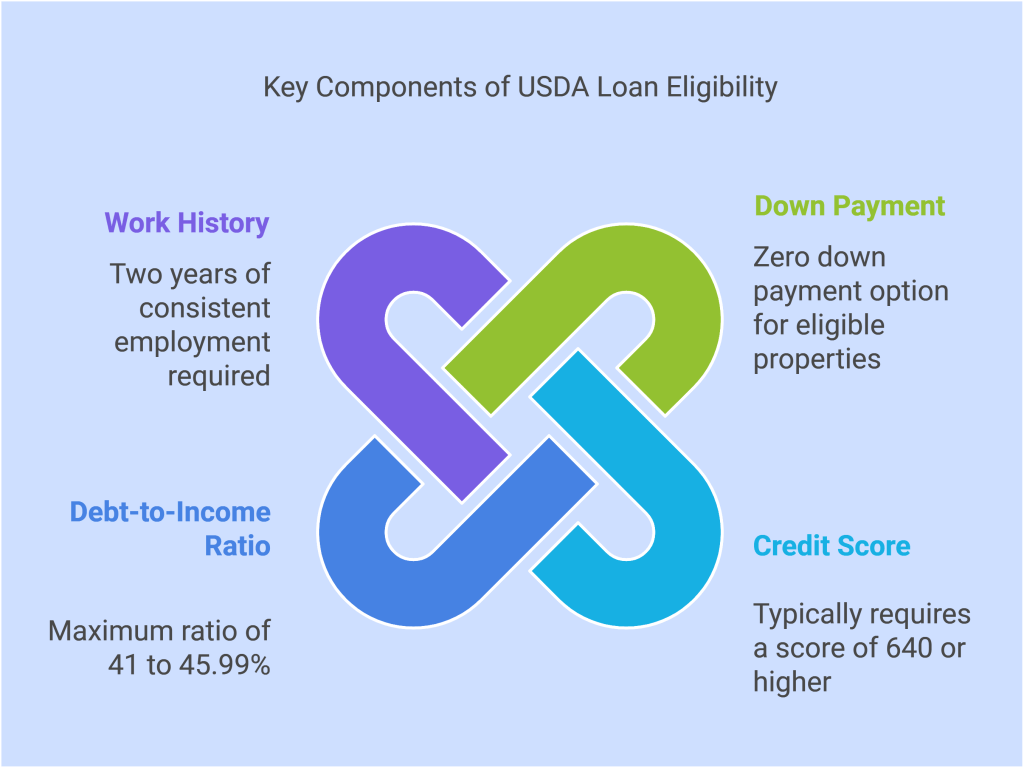

Kentucky USDA Loan Program

Down Payment: USDA loans offer zero down payment options for eligible properties in designated rural areas.

Credit Score: No lowest score. However, a credit score of 620 to 640 or higher is typically required for USDA loans.

Debt-to-Income Ratio: Maximum DTI ratio is 41 to 45.99%, although some lenders may allow higher ratios with compensating factors.

Work History: A two year employment history and consistent income are important for USDA loan approval.

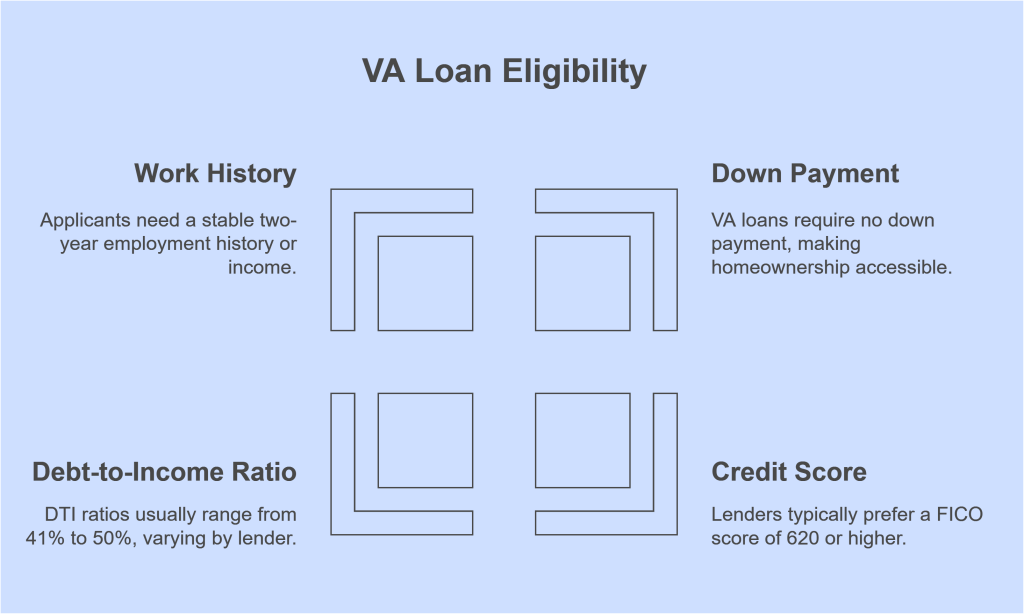

Kentucky VA Loan Program

Down Payment:*VA loans offer zero down payment options for eligible veterans, active-duty service members, and spouses.

Credit Score:While there is no specific credit score requirement, most lenders prefer a FICO score of 620 or higher.

Debt-to-Income Ratio:Maximum DTI ratio varies by lender but generally ranges from 41% to 50%.

Work History: VA loan applicants should have a two year stable employment history or a reliable source of income.

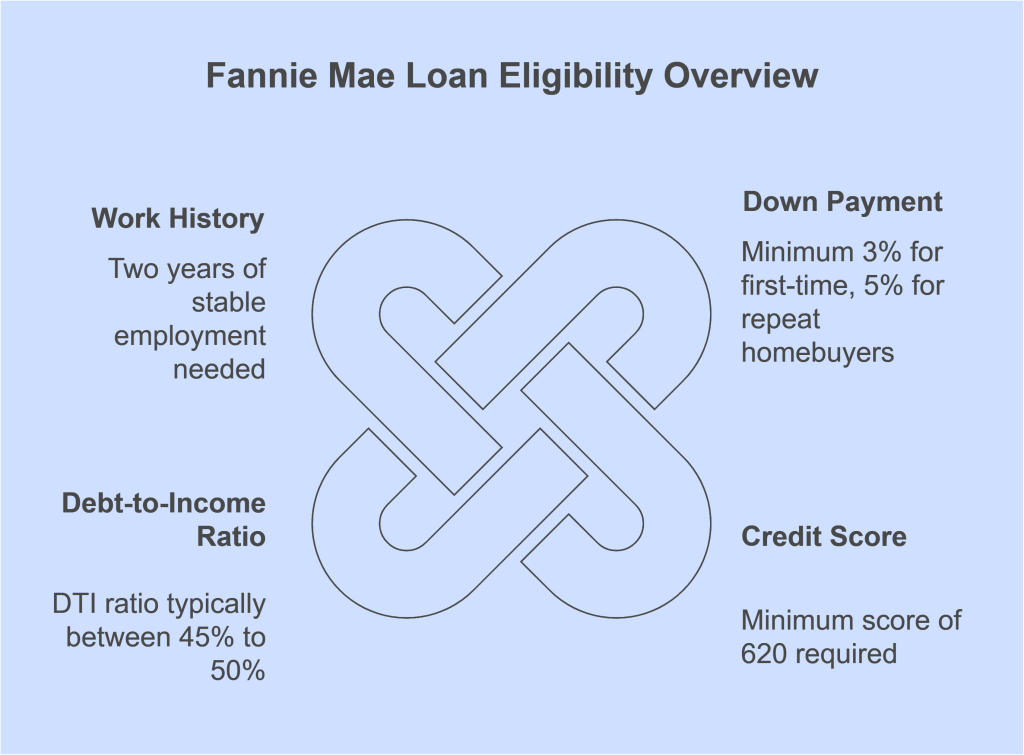

Kentucky Fannie Mae Loan Program

Down Payment: Fannie Mae loans may require a down payment as low as 3% for first-time homebuyers, and 5% down for repeat homebuyers

Credit Score: A minimum credit score of 620 or higher is typically required for Fannie Mae loans.

Debt-to-Income Ratio: Maximum DTI ratio varies by lender and loan program but generally ranges from 45% to 50%.

Work History: A two year stable employment history with steady income is important for Fannie Mae loan approval.

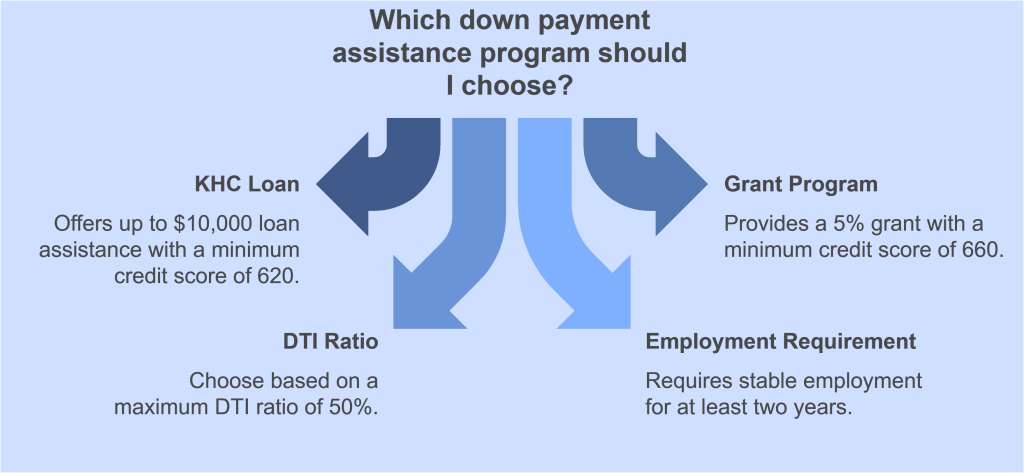

Kentucky Housing Down Payment Assistance Programs

Kentucky offers various down payment assistance programs. One example is the Kentucky Housing Corporation (KHC) Down Payment Assistance Program. This program provides financial assistance to eligible homebuyers.

Down Payment: Down payment assistance programs can help cover part or all of the down payment requirement. This depends on the program and eligibility criteria. $12,500 down payment assistance loan through KHC and 5% grant program through other lenders.

Credit Score: 620 Minimum credit score requirements vary by program. They are generally in line with FHA or conventional loan requirements. These requirements are 660.

Debt-to-Income Ratio: Maximum DTI ratio may vary by program, and additional guidelines may apply. 50% to 50% typically is the range

Work History: Two year Stable employment and income verification are typically required for down payment assistance program eligibility.

Navigating the home buying process in Kentucky can be complex. It requires understanding the requirements and benefits of various loan programs. You also need to consider down payment assistance options. You can choose an FHA, USDA, VA, or Fannie Mae loan. You may also utilize Kentucky Housing Down Payment Assistance Programs. A knowledgeable mortgage professional can guide you. They help in finding the right financing solution for your first house purchase in Kentucky.

Joel Lobb Mortgage Loan Officer

Text/call: 502-905-3708

email: kentuckyloan@gmail.com

http://www.mylouisvillekentuckymortgage.com/

Company NMLS# 1738461

Personal NMLS# 57916

The view and opinions stated on this website belong solely to the authors, and are intended for informational purposes only. The posted information does not guarantee approval, nor does it comprise full underwriting guidelines. This does not represent being part of a government agency. The views expressed on this post are mine and do not necessarily reflect the view of my employer. Not all products or services mentioned on this site may fit all people.

NMLS ID# 57916, (www.nmlsconsumeraccess.org).

4 thoughts on “ A Guide to Buying Your First House in Kentucky: Loan Programs and Requirements”