In today’s dynamic employment landscape, many professionals earn variable income through commissions, bonuses, overtime, or gig work. While this income structure offers flexibility, it can present challenges when seeking mortgage approval. Understanding how major loan programs—FHA, VA, USDA, and Fannie Mae—evaluate variable income is crucial for prospective borrowers.

FHA Loans: Flexibility with Documentation

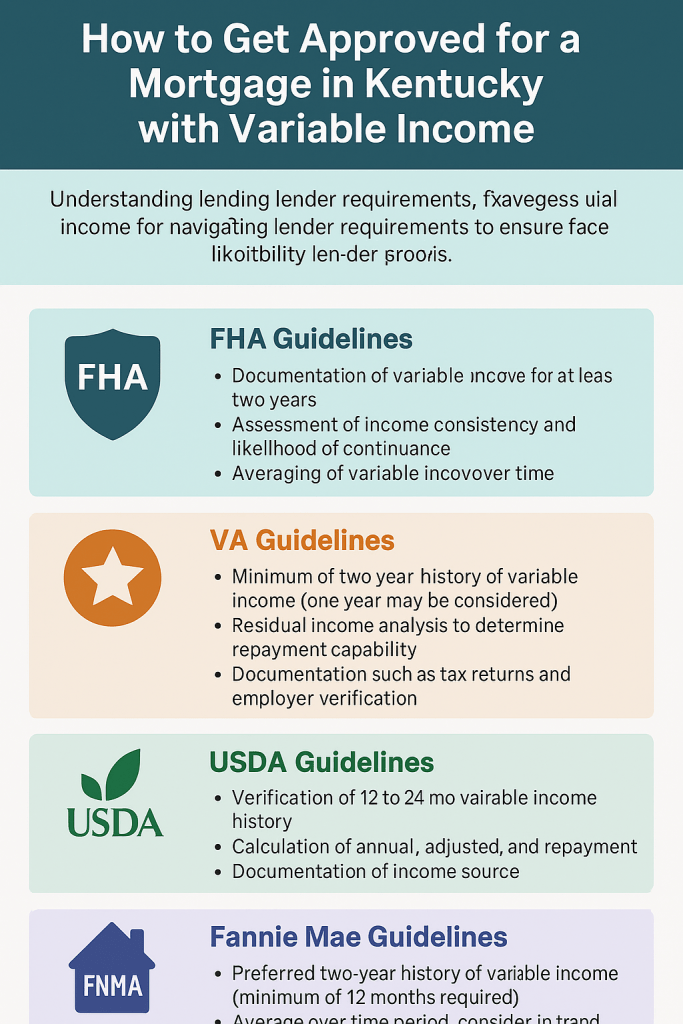

The Federal Housing Administration (FHA) recognizes the realities of variable income and offers guidelines to accommodate such earnings. Key considerations include:

- Documentation: Borrowers must provide evidence of variable income over a consistent period, typically two years. Acceptable documentation includes W-2 forms, pay stubs, and tax returns.

- Consistency and Continuance: Lenders assess the stability of variable income and its likelihood to continue. A consistent earning pattern enhances approval prospects.

- Averaging Income: FHA guidelines allow lenders to average variable income over the documented period to determine qualifying income.

Reference: FHA Single Family Housing Policy Handbook

VA Loans: Emphasis on Stability and Residual Income

For veterans and active-duty service members, the Department of Veterans Affairs (VA) provides favorable loan terms. When evaluating variable income:

- History of Earnings: A minimum of two years of consistent variable income is typically required. However, one year may suffice if the income is likely to continue.

- Residual Income Analysis: VA loans utilize residual income calculations. This ensures that borrowers can cover living expenses after mortgage payments. This approach offers flexibility beyond traditional debt-to-income ratios.

- Documentation: Comprehensive records, including tax returns and employer verification, are essential to substantiate variable income.

Reference: VA Lender’s Handbook Chapter 4

USDA Loans: Rigorous Verification for Rural Homebuyers

The U.S. Department of Agriculture (USDA) supports homebuyers in rural areas through its loan programs. For applicants with variable income:

- Verification Period: A consistent history of variable income over 12 to 24 months is necessary, demonstrating stability and reliability.

- Income Calculation: Lenders must calculate and document annual, adjusted, and repayment income, considering all adult household members’ earnings.

- Documentation Requirements: Detailed records, including pay stubs, tax returns, and employment verification, are mandatory to validate income sources.

Reference: USDA HB-1-3555 Chapter 9

Fannie Mae: Detailed Analysis for Conventional Loans

Fannie Mae offers conventional loan options with specific guidelines for variable income:

- Income History: At least 12 months of variable income is required. A two-year history is preferred to establish stability.

- Averaging Method: Lenders average variable income over the documented period, considering factors like frequency and trend of earnings.

- Continuance Assessment: Evaluating the likelihood of income continuation is critical, often necessitating employer confirmation or industry stability analysis.

Reference: Fannie Mae Selling Guide B3-3.1-01

Strategic Considerations for Borrowers

For individuals with variable income seeking mortgage approval:

- Maintain Comprehensive Records: Keep detailed documentation of all income sources, including pay stubs, tax returns, and contracts.

- Demonstrate Stability: A consistent income pattern over the required period strengthens your application.

- Consult with Lenders Early: Engage with mortgage professionals to understand specific program requirements and prepare accordingly.

- Consider Program Flexibility: Evaluate which loan program aligns best with your income structure and financial goals.

Summary Table: Variable Income Guidelines by Loan Program for Kentucky Mortgage Loans with commissions, tips, gig income, overtime, bonus etc.

| Loan Program | Minimum History | Averaging Allowed | Key Documentation | Special Considerations |

|---|---|---|---|---|

| FHA | 2 years (typical) | Yes | W-2s, pay stubs, tax returns | Consistency, likelihood to continue |

| VA | 2 years (1 year possible) | Yes | W-2s, tax returns, employer verification | Residual income analysis |

| USDA | 12–24 months | Yes | Pay stubs, tax returns, employment verification | All household income counted |

| Fannie Mae | 12–24 months | Yes | W-2s, pay stubs, tax returns | Trend and continuance are critical |

Conclusion

Securing a mortgage with variable income is achievable with thorough preparation and understanding of lender requirements. Borrowers can navigate the approval process for FHA, VA, USDA, and Fannie Mae loan programs. They should maintain detailed records and demonstrate income stability. Engaging with knowledgeable mortgage professionals can further enhance your prospects of homeownership.

Note: This blog post is for informational purposes only and does not constitute financial advice. Always consult with a qualified mortgage professional for personalized guidance.

1 – Email – kentuckyloan@gmail.com 2. Call/Text – 502-905-3708

Joel Lobb

Mortgage Loan Officer – Expert on Kentucky Mortgage Loans

www.mylouisvillekentuckymortgage.com

911 Barret Ave., Louisville, KY 40204

Evo Mortgage

Company NMLS# 1738461

Personal NMLS# 57916

For assistance with Kentucky mortgage loans, reach out via email, call, or text Joel Lobb directly.

Kentucky Local Home Loan Lender Services

First-Time Home Buyers Welcome

FHA, Rural Housing (USDA), VA, and Kentucky Housing Corporation (KHC) Loans

Conventional Loan Options Available

Fast Local Decision-Making

Experienced Guidance Through the Home Buying Process