Understanding Federal Loan Programs for Kentucky First-Timers: Expanding Your Options

Several federal loan programs are widely accessible beyond the state-specific programs offered by KHC. They can be excellent options for first-time home buyers in Kentucky. These programs are backed by the federal government, which often allows for more lenient qualification requirements compared to traditional loans.

FHA Loans, insured by the Federal Housing Administration, are a popular choice for first-time buyers. This is due to their generally easier qualification criteria. A primary benefit of an FHA loan is the low down payment requirement. It can be as little as 3.5% of the purchase price for borrowers with a credit score of 580 or higher.

Some lenders might accept credit scores as low as 500. However, this typically comes with a higher down payment requirement. Often, it is around 10%.

FHA loans require borrowers to pay mortgage insurance premiums (MIP). These premiums include an upfront premium and ongoing annual premiums.

Loan limits for FHA loans in Kentucky vary by county. Remember that FHA loans are intended for primary residences only.

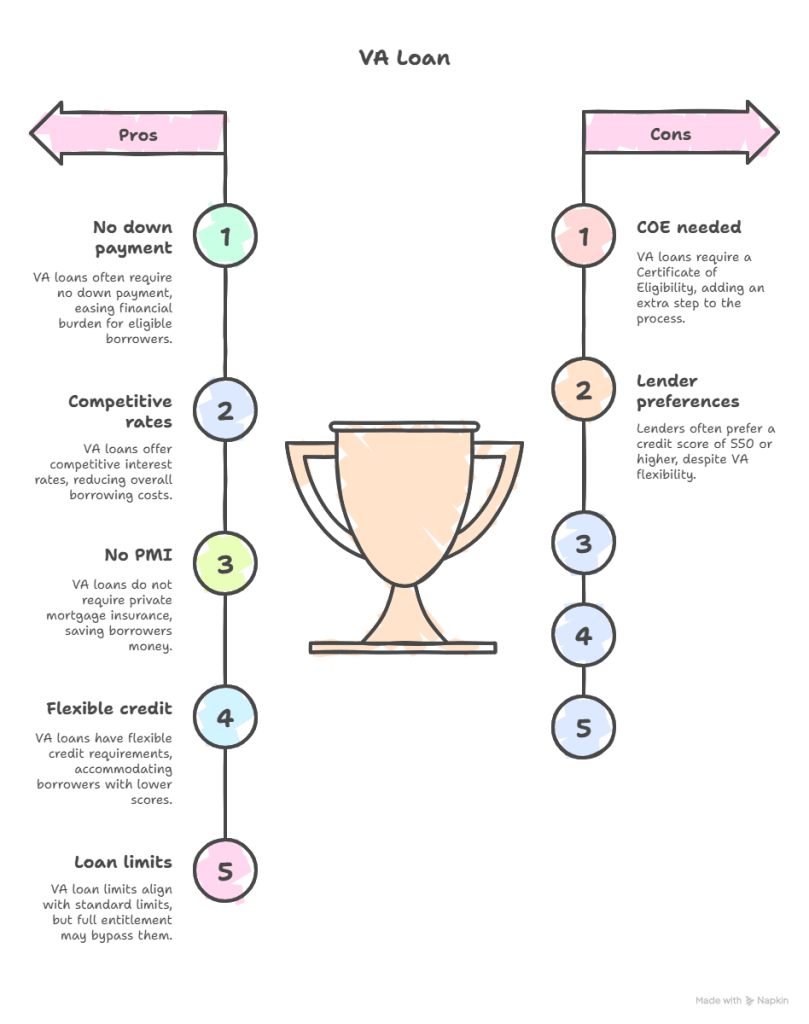

VA Loans, guaranteed by the U.S. Department of Veterans Affairs, are a fantastic option for eligible active-duty military personnel, veterans, and surviving spouses.

A significant benefit of VA loans is that they often require no down payment.They also typically come with more competitive interest rates compared to conventional loans

Another major advantage is that private mortgage insurance (PMI) is not required with VA loans.13

The VA doesn’t set a strict minimum credit score requirement. However, many lenders prefer a score of at least 620 or higher. Loan limits in Kentucky generally align with the standard VA loan limit.

those with full VA loan entitlement may not be restricted by these limits.

To be eligible for a VA loan, you’ll typically need a Certificate of Eligibility (COE). It verifies your service history.

USDA Loans, offered by the U.S. Department of Agriculture, are designed to help low-to-moderate-income borrowers purchase homes in eligible rural areas. A significant draw of USDA loans is the potential for no down payment options. It offers 100% financing to qualified borrowers.

USDA loans don’t require private mortgage insurance (PMI). However, they typically involve an upfront guarantee fee and an annual fee. Credit score requirements can be flexible, with some lenders preferring a minimum score around 580-620. Income limits apply to USDA loans and vary by location.

Generally, they do not exceed 115% of the median household income for the specific rural area for Guaranteed Loans.27 The property you wish to purchase must be located in a USDA-eligible rural area. This is typically defined as communities with a population of 35,000 or less.7

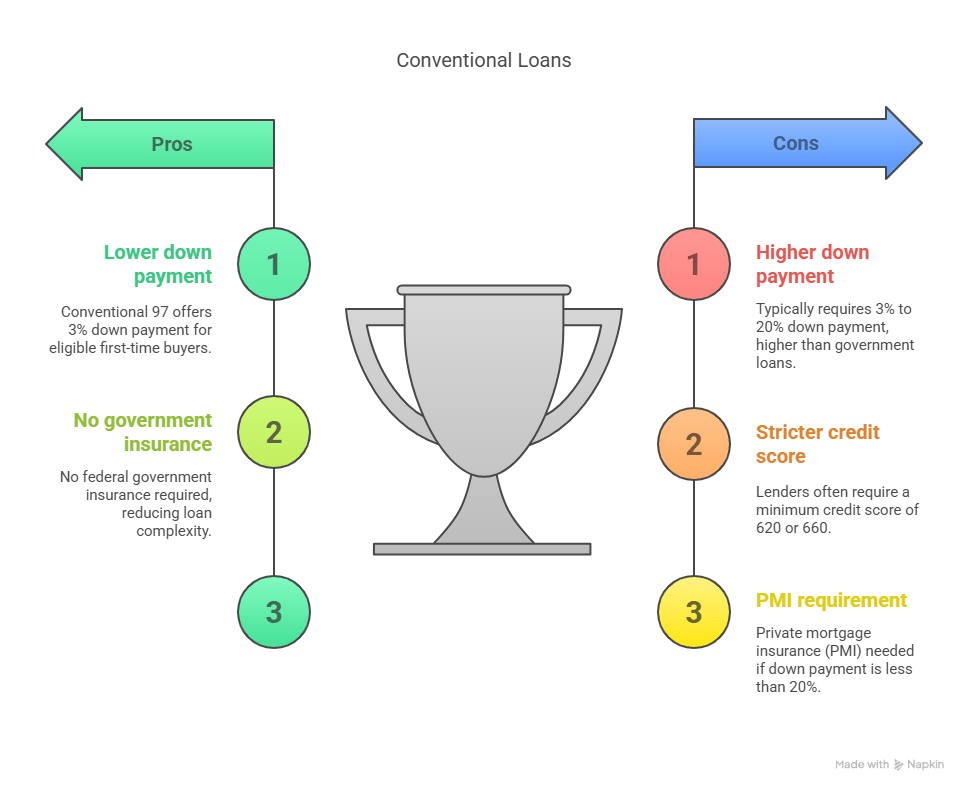

Finally, Conventional Loans are mortgages that are not insured or guaranteed by the federal government. These loans generally require a higher down payment compared to government-backed loans. The down payment often ranges from 3% to 20% or more.1

They have stricter credit score requirements. Many lenders look for a minimum score of 620 or even 660. If your down payment is less than 20% of the purchase price, your lender will likely require private mortgage insurance (PMI).

This is typically required with a conventional loan. However, some conventional loan programs offer a lower down payment option of just 3%. The Conventional 97 loan is backed by Fannie Mae or Freddie Mac. It is available for eligible first-time buyers with a qualifying credit score, often around 620.

The diverse federal and state-specific loan programs provide various options for first-time home buyers in Kentucky. This availability offers a wide array of choices.

Each program comes with its own set of advantages and eligibility criteria. This allows buyers to explore the options that best align with their individual financial circumstances. These options could be based on their credit score. They might also depend on income level, profession (military service), or the location of the property they are interested in.

The lower credit score requirements and down payment options associated with FHA, VA, and USDA loans highlight efforts. These efforts are to make homeownership more accessible. These efforts primarily aim to assist individuals who might face challenges qualifying for traditional conventional loans.

These government-backed programs play a crucial role in expanding homeownership opportunities. They are particularly beneficial for those entering the real estate market for the first time. Many have potentially limited savings or a shorter credit history.

—

1 – Email – kentuckyloan@gmail.com 2. Call/Text – 502-905-3708

Joel Lobb

Mortgage Loan Officer – Expert on Kentucky Mortgage Loans

Website: www.mylouisvillekentuckymortgage.com

Website: www.mylouisvillekentuckymortgage.com Address: 911 Barret Ave., Louisville, KY 40204

Address: 911 Barret Ave., Louisville, KY 40204

Evo Mortgage

Company NMLS# 1738461

Personal NMLS# 57916

For assistance with Kentucky mortgage loans, reach out via email, call, or text Joel Lobb directly.

Kentucky Local Home Loan Lender Services

First-Time Home Buyers Welcome

First-Time Home Buyers Welcome FHA, Rural Housing (USDA), VA, and Kentucky Housing Corporation (KHC) Loans

FHA, Rural Housing (USDA), VA, and Kentucky Housing Corporation (KHC) Loans Conventional Loan Options Available

Conventional Loan Options Available Fast Local Decision-Making

Fast Local Decision-Making Experienced Guidance Through the Home Buying Process

Experienced Guidance Through the Home Buying Process