—

Share this:

- Share on LinkedIn (Opens in new window) LinkedIn

- Share on Tumblr (Opens in new window) Tumblr

- Share on X (Opens in new window) X

- Share on Reddit (Opens in new window) Reddit

- Email a link to a friend (Opens in new window) Email

- Share on Bluesky (Opens in new window) Bluesky

- Share on WhatsApp (Opens in new window) WhatsApp

- Share on X (Opens in new window) X

- Share on Threads (Opens in new window) Threads

- Print (Opens in new window) Print

- Share on Facebook (Opens in new window) Facebook

- Share on Pinterest (Opens in new window) Pinterest

- Share on Pocket (Opens in new window) Pocket

- Share on Telegram (Opens in new window) Telegram

- Share on Nextdoor (Opens in new window) Nextdoor

- Share on Mastodon (Opens in new window) Mastodon

Reblogged this on Kentucky VA Mortgage Home Lender and commented:

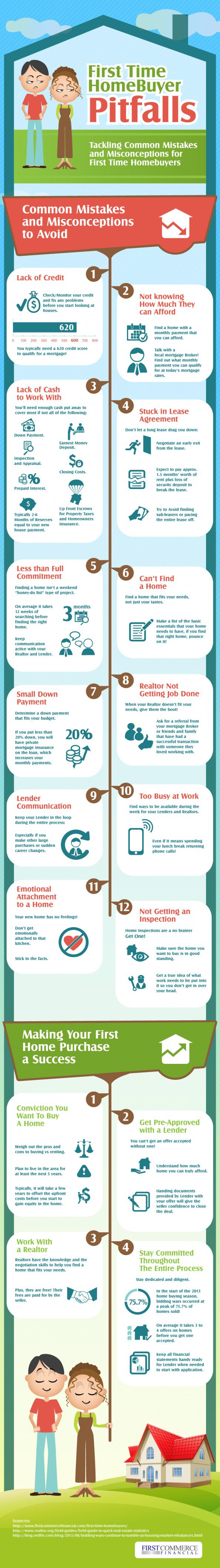

There are basically three things we look at: Credit, Income, Assets.

Credit:

You must have a minimum credit score of 640

Typically they want you to have a 2 year work history, does not have to be on same job, and the house payment should not be more than 1/3 of your gross income. For example, if you make 2k gross a month, then your max house payment should be around $700-800 range.

As far assets, you typically don’t need a down payment, but it is always good to show at least 2 months reserves in the bank.

You will have to pay for an appraisal fee of $325, and home inspection of $400-350 typically, but this is usually the only out of pocket costs.

The seller can pay your closing costs, and it takes about 30 days to close a loan when you get a accepted offer.

If you don’t mind, go ahead and get the following things together and I will see what you how much qualify for on a home.

This is a free process, in case you were wondering.

The following is a list of documents that may be required to process your mortgage loan:

One full month’s worth of pay stubs

Last 2 years W-2’s

Last 2 years tax returns with all schedules

Last two months bank statements for all accounts

Documentation to support your funds to close

Explanation for any derogatory credit (if applicable)

Bankruptcy and discharge paperwork (if applicable)

Divorce decree and settlement paperwork (if applicable)

Read more: http://www.mylouisvillekentuckymortgage.com/

LikeLike