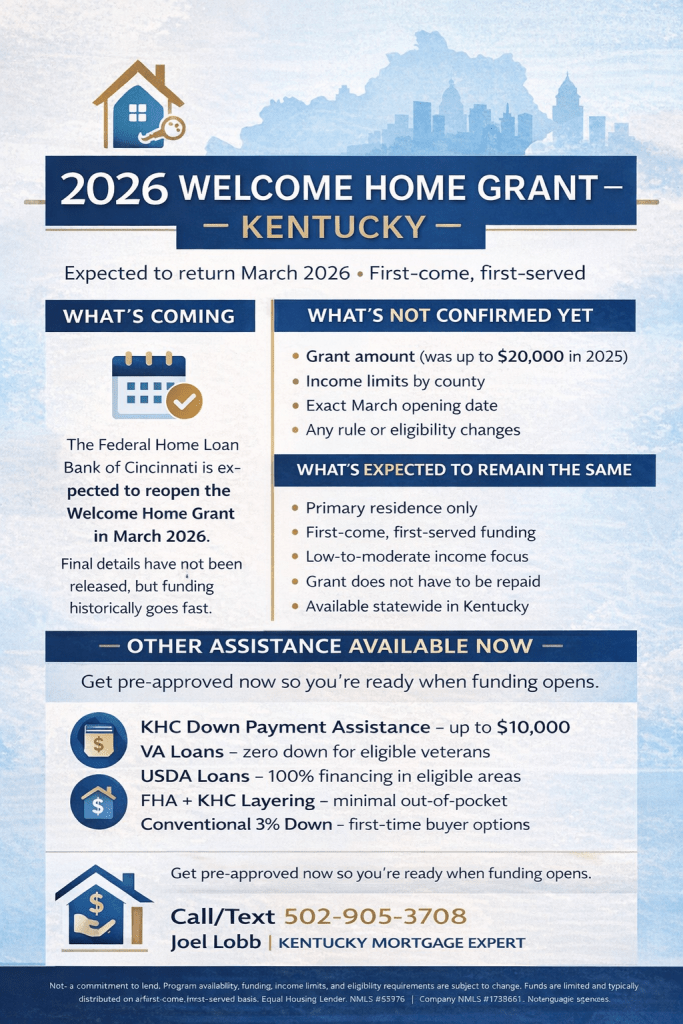

2026 Welcome Home Grant Kentucky: Timing, Expectations, and Smart Planning Tips

The Federal Home Loan Bank of Cincinnati plans to reopen the Welcome Home Grant program in March 2026. Final 2026 details have not been released yet, but if the program follows prior years, funding will move fast and will likely be distributed on a first-come, first-served basis.

This page will be updated as soon as official 2026 program details are announced. If you want to be positioned to act the moment it opens, the most effective move is to get your mortgage file prepped early.

2025 Program Status Recap

The 2025 Welcome Home Grant officially closed on March 13, 2025. Limited funding was quickly reserved shortly after opening, which is why preparation matters going into 2026.

What to Expect for the 2026 Welcome Home Grant

Based on how the program operated in 2025, the 2026 version will likely look similar. That said, nothing is final until the program guidelines are published.

Not yet confirmed for 2026

- Grant amount (was up to $20,000 in 2025)

- Income limits by county

- Exact opening date in March

- Any eligibility or guideline changes

Expected to remain consistent

- Primary residence requirement

- First-come, first-served distribution

- Designed for low-to-moderate income households

- Grant funds are not repaid (not a loan)

- Available statewide in Kentucky (subject to program guidelines)

How to Stay Ahead of the 2026 Opening

When the grant opens, there is usually no time to “start the process.” You want your loan plan and documentation ready so you can move immediately.

- Get pre-approved early so your file is ready when funding opens

- Stay connected for real-time updates

- Check back in early March 2026 for official program announcements

Want help building a game plan? Call/Text (502) 905-3708 or contact me below.

Alternative Down Payment Assistance Available Right Now

You do not have to wait until 2026 to buy a home. Depending on your income, credit, location, and eligibility, there may be options available immediately.

Kentucky Housing Corporation (KHC) Down Payment Assistance

Up to $10,000 in down payment help for first-time and repeat buyers. Often works with FHA, VA, USDA, and Conventional loans. Learn more about KHC down payment assistance.

VA Loans (For Veterans and Active-Duty Service Members)

No down payment required and no monthly mortgage insurance. Competitive rates for those who qualify. Kentucky VA loan overview.

USDA Loans (Rural Eligible Areas)

100% financing available in eligible rural and suburban areas. Many parts of Kentucky qualify. Check Kentucky USDA loan basics.

FHA Loans with KHC Layering

As little as 3.5% down plus KHC assistance may reduce out-of-pocket costs significantly. Kentucky FHA loan guide.

Conventional 3% Down Options

First-time buyer options may include reduced PMI and potential layering with eligible grants or assistance programs. Conventional loan options.

FHA Smart Down Payment Assistance

A 5% grant program paired with FHA financing can be a strong fit for qualified buyers. Explore down payment assistance in Kentucky.

The Smart Move: Get Pre-Approved Now

Grant programs reward preparation. A solid pre-approval gets you positioned to move quickly when funding opens and helps you compare down payment assistance options that are available right now.

Same-day pre-approvals available for qualified buyers.

Contact Joel

Email: joel@example.com

Call/Text: (502) 905-3708