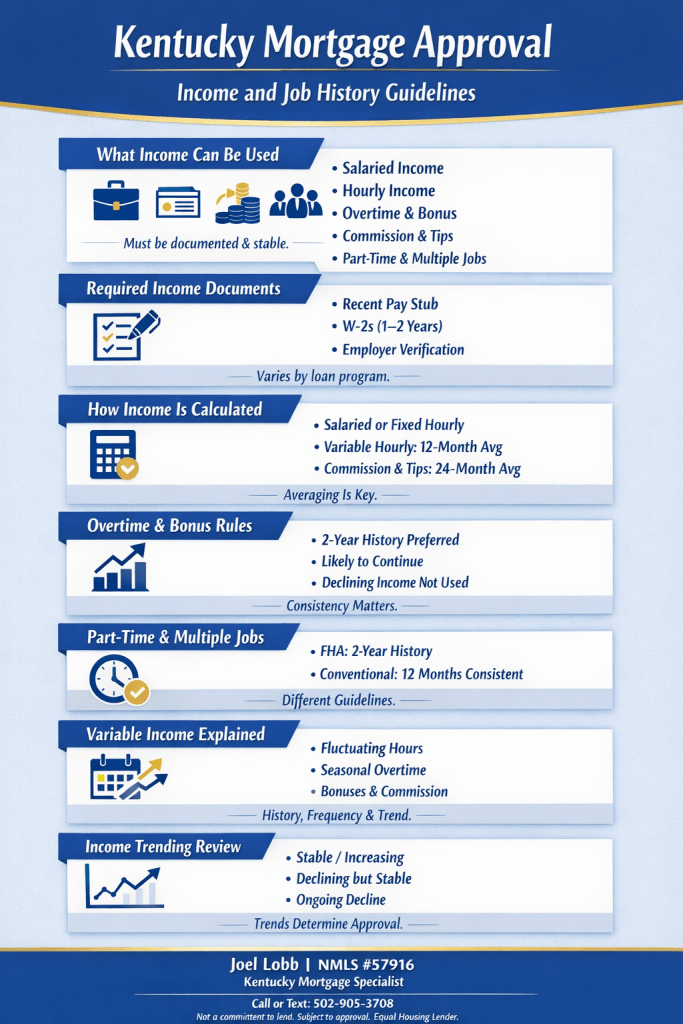

Kentucky Mortgage Approval

Income and Job History Guidelines

What income can be used

- Salaried income

- Hourly income

- Overtime and bonus

- Commission and tips

- Part-time and multiple jobs

Must be documented and stable.

Required income documents

- Recent pay stub (shows year-to-date earnings)

- W-2s (1–2 years, depending on income type)

- Employer verification (verbal or full VOE)

Requirements vary by loan program and employment profile.

How income is calculated

- Salaried or fixed hourly: based on year-to-date gross income

- Variable hourly (fluctuating hours): 12-month average

- Commission and tips: 24-month average

Averaging is the standard method.

Overtime and bonus rules

- Two-year history is preferred

- Must be likely to continue

- Declining overtime/bonus typically cannot be used

Consistency matters more than spikes.

Part-time and multiple jobs

- FHA: generally requires a 2-year history

- Conventional (Fannie Mae): may allow 12 months if consistent and supported by positive factors

Guidelines differ by program.

Variable income explained

- Fluctuating hours

- Seasonal overtime

- Bonuses and commission

Reviewed for history, frequency, and trend.

Income trending review

- Stable or increasing: average may be used

- Declining but now stable: current lower amount may be used

- Ongoing decline: income may not qualify

Trends can determine approval.

Reblogged this on Louisville Kentucky Mortgage Loans and commented:

What kind of income is allowed and needed for a FHA, VA, USDA and Fannie Mae Mortgage Loan Approval in Kentucky?

LikeLike