Conventional loan A conventional loan isn’t insured or guaranteed by a government entity. You can take one out through a private lender like a bank, credit union or mortgage company. While conventional loans are more difficult to qualify for than government loans, they’re also usually more flexible. Minimum credit score: 620 Minimum down payment: 3% … Continue reading Louisville Kentucky FHA Loans

Kentucky First-Time Home Buyer Loan Programs

Louisville Kentucky Mortgage Broker Offering FHA, VA, USDA, Conventional, and KHC Zero Down Payment Home Loans

Louisville Kentucky Mortgage Loans

KHC loan – Kentucky First-Time Homebuyer Loan Programs for FHA, VA, KHC and USDA Mortgage Loans in KY

Home Loans Preapproval Checklist

- A driver’s license or U.S. passport

- A Social Security number or card. If not a U.S. citizen, a copy of the front and back of your green card(s)

- Verification of employment

- Copy of their credit reports from the three national credit bureaus

- Recent pay stubs covering the last 30 days

- W-2 forms from the previous two years

- Proof of any additional income

- Last two years of personal federal income tax returns with all pages and schedules. If self-employed, last two years of individual federal income tax returns with all pages and schedules, as well as a business license, a year-to-date profit and loss statement (P&L), a balance sheet, and a signed CPA letter stating you are still in business

- Bank account statements proving that you have enough to…

View original post 688 more words

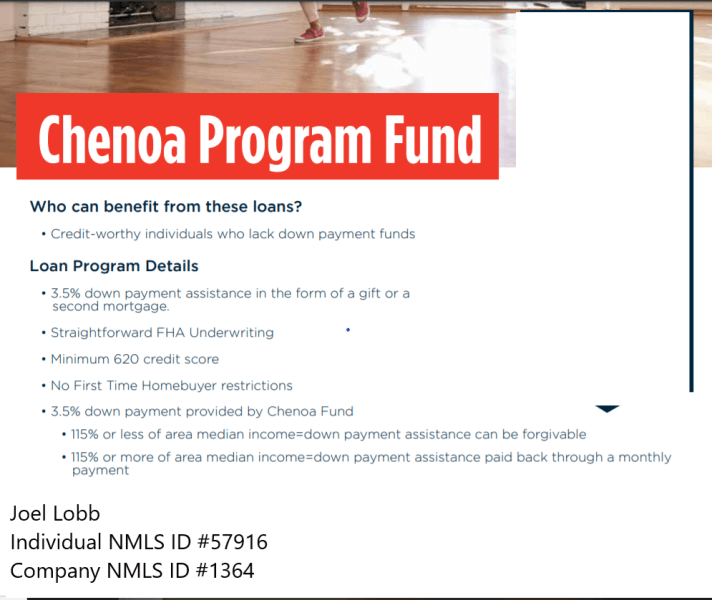

Chenoa Fund Down Payment Assistance Program in Kentucky

Chenoa Fund Down Payment Assistance Program in Kentucky

Louisville Kentucky Mortgage Loans

This Program is for any eligible potential home buyer and we operate in every state except for New York. In order to apply, you will need to work with an approved lender in your area. They will take and submit your application, assist to find the right program, and guide you through the process. The approved lender would assist with both the primary mortgage and the down payment loan and would be the one to provide any rate information.

In what state and county are you looking to purchase your home? We can send a list of approved lenders close to you that you can reach out to and apply.

You can find some general information about our program here: https://chenoafund.org/homebuyer/providing-down-payment-assistance-on-fha-and-conventional-loans.

In short, Chenoa Fund covers the entire down payment and provides 3.5% and 5% assistance on FHA and 3% and 5% on Fannie Mae conventional loans. Some basic information…

View original post 387 more words

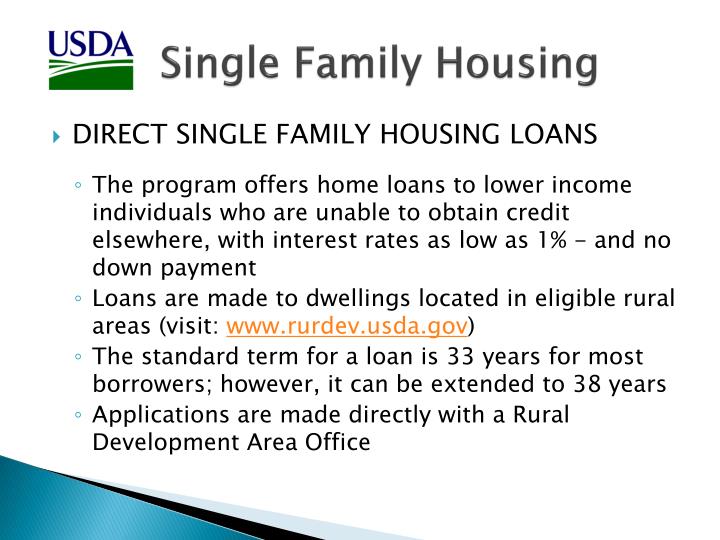

Kentucky USDA Rural Housing Loans Direct Programs Interest Rates

What is the interest rate and payback period?

Effective January 1, 2022, the current interest rate for Single Family Housing Direct home loans is 2.50% for low-income and very low-income borrowers.

Fixed interest rate based on current market rates at loan approval or loan closing, whichever is lower

Interest rate when modified by payment assistance, can be as low as 1%

Up to 33 year payback period – 38 year payback period for very low income applicants who can’t afford the 33 year loan term

Not the same as the USDA Rural Housing Guaranteed Program. These rates follow the secondary market and change daily like FHA, VA, Conventional Mortgage Loans and set by individual lenders based on lock period, credit score, loan amount, state, and other incentivesthe current interest rate for Single Family Housing Direct Home Loans

The USDA 502 Direct Loan Program helps low- and very-low-income applicants in federally-determined rural areas of the state obtain decent, safe and sanitary housing in eligible rural areas by providing payment assistance to increase an applicant’s repayment ability. This payment assistance is a type of subsidy that reduces the mortgage payment. The amount of assistance is determined by the adjusted family income.A number of factors are considered when determining an applicant’s eligibility for this loan. At a minimum, applicants interested in obtaining a direct loan must have an adjusted income that is at or below the applicable low-income limit for the area where they wish to buy a house and they must demonstrate a willingness and ability to repay debt.

This is a zero down payment loan.

Program Fact Sheet

Program Forms & Resources

Click here for the current rate for the USDA 502 Direct Loan Program

Louisville Kentucky Mortgage Loans

What is the interest rate and payback period?

- EffectiveJanuary 1, 2022, the current interest rate for Single Family Housing Direct home loans is 2.50% for low-incomeand very low-income borrowers.

- Fixed interest rate based on current market rates at loan approval or loan closing, whichever is lower

- Interest rate when modified by payment assistance, can be as low as 1%

- Up to 33 year payback period – 38 year payback period for very low income applicants who can’t afford the 33 year loan term

Not the same as theUSDA Rural Housing Guaranteed Program. These rates follow the secondary market and change daily like FHA, VA, Conventional Mortgage Loans and set by individual lenders based on lock period, credit score, loan amount, state, and other incentives

The USDA 502 Direct Loan Program helpslow- and very-low-income applicants in federally-determined…

View original post 136 more words

Western Kentucky are now eligible for low-interest loans from the U.S. Department of Agriculture

low-interest loans from the U.S. Department of Agriculture

Kentucky USDA Mortgage Lender for Rural Housing Loans

Several Kentucky counties eligible for low-interest USDA loans to repair agricultural damage

FRANKFORT, Ky. — Several Kentucky counties affected by the December 2021 storms that produced tornadoes and high winds in Western Kentucky are now eligible for low-interest loans from the U.S. Department of Agriculture, Kentucky Commissioner of Agriculture Dr. Ryan Quarles recently announced.

“Both my office and I have been on the ground in western Kentucky and witnessed the historic and devastating destruction that hit the region last month,” Commissioner Quarles said. “Our farmers need funds and resources to maintain operations and rebuild. The low-interest loans offered by USDA may help some get back on their feet and regain some sense of normalcy.”

The low-interest loans offered by USDA are for physical losses and can help producers repair or replace damaged or destroyed physical property essential to the success of the agricultural operation, including livestock losses. Examples of property…

View original post 119 more words