Fannie Mae announced that their Automated Underwriting System will now take an AVERAGE of the two scores for qualifying Do you and your partner have very different credit scores? Great news! You may have access to more loan program options than you thought! Here's the deal... All lenders pull FICO scores from each of the … Continue reading Effective on 9/18/21, Fannie Mae announced that their Automated Underwriting System will now take an AVERAGE of the two scores for qualifying

Kentucky Mortgage Terms to Know

Glossary of Mortgage Terms to Know For A Kentucky Mortgage Loan. ACCRUED INTEREST: Accumulated interest since the principal investment that hasnot yet been paid.AMORTIZATION: Paying off debt, principal and interest, with a fixed repayment schedulein regular installments over a fixed period of time.ANNUAL PERCENTAGE RATE (APR): The annual rate charged for borrowing moneyexpressed as a … Continue reading Kentucky Mortgage Terms to Know

What are the Kentucky FHA Credit Score Requirements for 2020 Mortgage Loan Approvals?

If you are looking to refinance your mortgage loan, you’ll want to be prepared to meet your lender’s criteria and educate yourself about your FICO® Scores as they are the credit scores most commonly used in the mortgage refinancing process. As there are different versions of the FICO Score, it’s important that you focus on … Continue reading What are the Kentucky FHA Credit Score Requirements for 2020 Mortgage Loan Approvals?

Credit Scores for Kentucky VA, FHA, USDA , Fannie Mae Home Loans

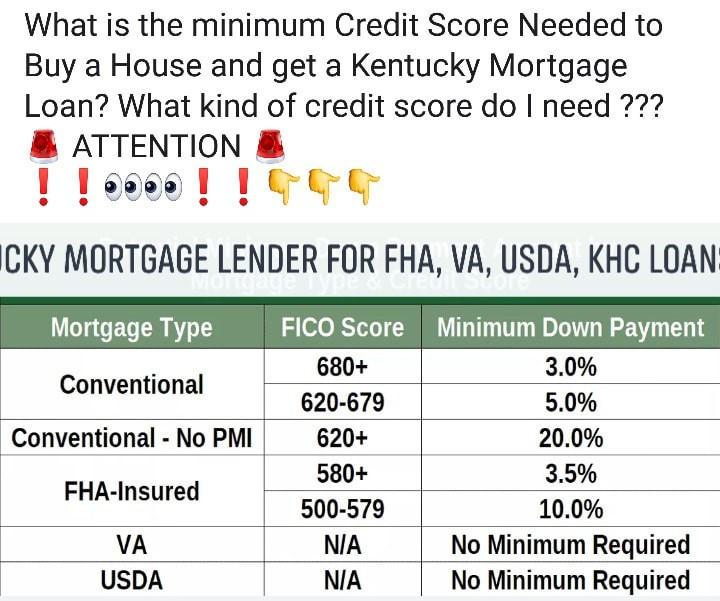

What is the minimum credit score I need to qualify for a Kentucky FHA, VA, USDA and KHC Conventional mortgage loan in 2020?

Louisville Kentucky Mortgage Loans

Credit Scores for Kentucky VA, FHA, USDA , Fannie Mae Home Loans

Call 502 905 3708 or email us at kentuckyloan@gmail.com for your free Kentucky Mortgage Application and Credit Report

Call 502 905 3708 or email us at kentuckyloan@gmail.com for your free Kentucky Mortgage Application and Credit Report

A credit score is a number that helps lenders and others predict how likely you are to make your credit payments on time. Each score is based on the information then in your credit report.

Why Do Your Scores Matter?

Credit scores affect whether you can get credit and what you pay for credit cards, auto loans, mortgages and other kinds of credit. For most kinds of credit scores, higher scores mean you are more likely to be approved and pay a lower interest rate on new credit.

Want to rent an apartment? Without good scores, your apartment application may be turned down by the landlord. Your scores also may determine how big a deposit you will have to pay…

View original post 2,579 more words

How are collections treated on a Mortgage loan in Kentucky for a FHA and Conventional Loan Approval?

Collection Account Tips for Fannie Mae and FHA Loan in Kentucky. Do they have to be paid to get approved for a Kentucky Mortgage Loan? Collection accounts on the credit report can sometimes hurt your chances of getting approved for a Kentucky Mortgage loan in Two ways: First, if collections are recent, they may drag … Continue reading How are collections treated on a Mortgage loan in Kentucky for a FHA and Conventional Loan Approval?