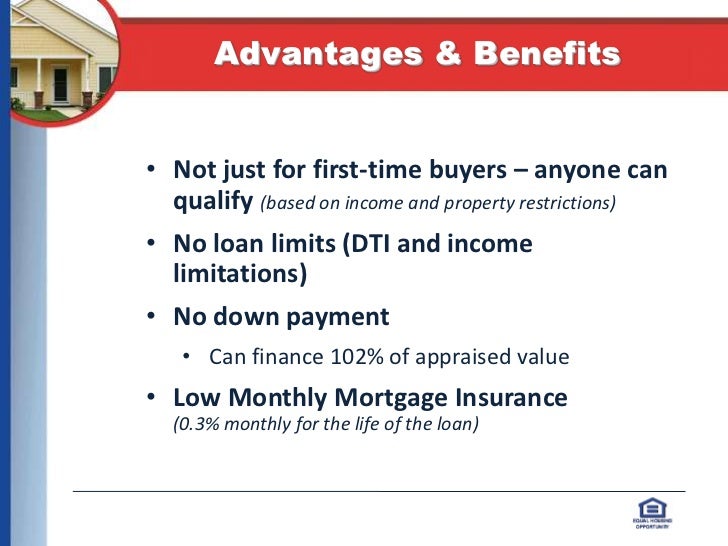

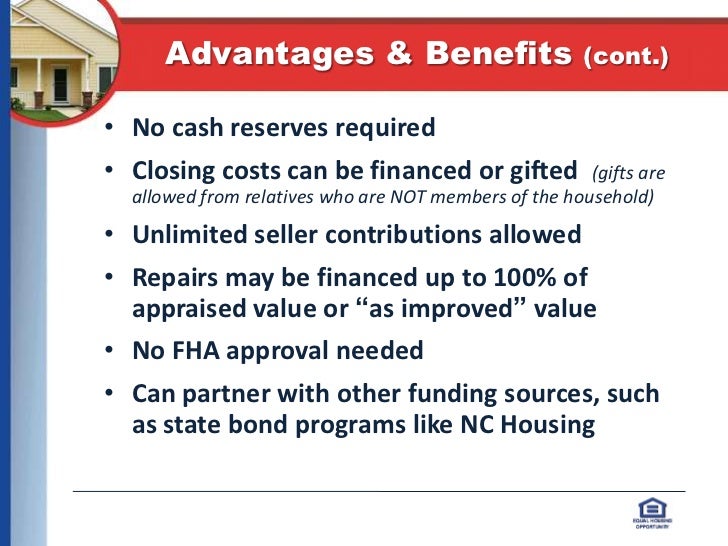

4 Things Every Borrower Needs to Get Approved for a Mortgage or Home Loan In Kentucky https://youtu.be/WuqF-TzPXX8 Kentucky First Time Home Buyer Common Questions and Answers: ∘ What kind of credit score do I need to qualify for different first time home buyer loans in Kentucky? Answer. Most lenders will wants a middle credit score … Continue reading First Time Home Buyer Louisville Kentucky Mortgage Programs

Kentucky Mortgage Broker Offering FHA, VA, USDA, Conventional, and KHC Down Payment Assistance Home Loans $100 Down FHA Mortgage, $5,000 Welcome Home Grant KY, 100% Financing, 100% financing Kentucky Home Loan, 2021 Credit score requirements for Kentucky Mortgage Loan, Common Questions from Kentucky First-time Homebuyers, Credit Score First Time Home Buyer Louisville Kentucky KHC, First Time Home Buyer in Kentucky Zero Down, First Time Home Buyer Loans--Kentucky, First Time home Buyer PRgoams, First Time Home Buyer Programs Louisville Kentucky, How Long Do I Have To Be Employed to Qualify for an Kentucky FHA Loan?, How Much Income Do I Need to Qualify for an Kentucky FHA Home Loan?, Kentucky Fannie Mae REO Homes For Sale - HomePath.com, Kentucky Foreclosed Homes Link, Kentucky Home Buyer & Homeowner Mortgage Guide, Kentucky home grant, KENTUCKY HOUSING CORPORATION, Kentucky Housing Mortgage Rates Louisville Kentucky, Kentucky HUD Homes for $100 Down, Kentucky Mortgage Approval, Kentucky Mortgage Rates, Kentucky Mortgage Rates and Home Loan Options, Kentucky Mortgage Rates FHA VA KHC, Kentucky Mortgage Refinance Questions to ask, Kentucky Rural Housing and USDA Credit Score Requirements, Kentucky USDA Loan Adjusted Maximum Income Limits by County, Kentucky USDA Loans, KHC Down payment Assistance Program Kentucky Housing, KHC Kentucky Housing, Louisville First Time Buyer Mortgages, Louisville First Time Buyers, Louisville Kentucky FHA Loans Lexington Kentucky FHA Loans, Louisville Kentucky FHA Loans Lexington Kentucky FHA LoansElizabethtown Kentucky FHA Loans, Louisville Ky First Time Home Buyer Loan, rhs, rhs loans kentucky, rural housing, usda income limits Kentucky, USDA No money down mortgage Louisville Kentucky Kentucky housing corp 30 year fixed, VA, VA Loan REquirements for Kentucky, VA loans, welcome home funds ky