Joel Lobb (NMLS#57916) Senior Loan Officer American Mortgage Solutions, Inc. 10602 Timberwood Circle Suite 3 Louisville, KY 40223 Company ID #1364 | MB73346 Text/call 502-905-3708 kentuckyloan@gmail.com http://www.nmlsconsumeraccess.org/ If you are an individual with disabilities who needs accommodation, or you are having difficulty using our website to apply for a loan, please contact us at 502-905-3708. … Continue reading The Big Change with the Removal of Tax Liens and Judgments – Continental Credit

Top Tips for a Positive First-Time Home-Buying Experience

For FHA, VA, USDA, KHC

Photo by rawpixel.com on Pexels.com

Photo by rawpixel.com on Pexels.com

Making the leap and purchasing a home for the first time is a huge milestone. Sure, it sounds daunting, but it can also be a very rewarding process. It doesn’t have to be all stress and anxiety. In fact, with some early planning and knowledge of what to expect, your home-buying experience can even be enjoyable. Here are the basic things you need to know before you buy and move into your first home.

Start Saving Early

According to HuffPost, the best thing you can do for both your credit score and your savings account is start planning early. You’ll have more home buying options if you have more money for a down payment. And, with a good credit score, you’ll be able to secure the best possible interest for your mortgage. Plus, starting early gives family members time to get their own finances…

View original post 556 more words

FHA Mortgage Loans- Gifts to Pay off Debt to Qualify for a FHA Home Loan.

Do you know that a gift can be used to pay off Borrower’s debts to qualify on an Kentucky FHA Loan?

FHA Loans in Kentucky – Gifts to Pay off Debt Do you know that a gift can be used to pay off Borrower’s debts to qualify on an Kentucky FHA Loan? A regular gift (this does not include a gift of equity) may be used to pay off a Borrower’s debt(s) for qualifying purposes as long as both the gift funds and the debt(s) being paid off with the gift funds are accurately disclosed and assessed by AUS TOTAL Scorecard. Whenever a gift is received on an Kentucky FHA loan, regardless of what it is being used for, it carries certain risks that must be assessed by TOTAL Scorecard for qualifying purposes. When a gift is received to pay off debt(s), follow the steps below to ensure that TOTAL Scorecard accurately assesses the risk of using gift funds in paying off debt for qualifying:

|

View original post 270 more words

Kentucky First Time Home Buyer Tips for a Smooth Closing after loan pre-approval

What NOT To Do After You Apply for a Kentucky Mortgage Loan Approval

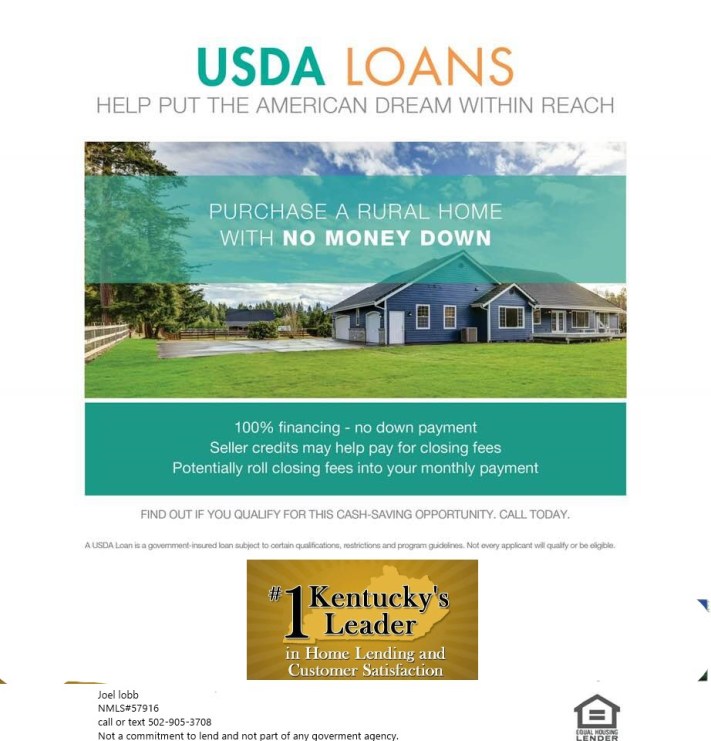

What is a Kentucky USDA Rural home loan?

Kentucky property kentucky rural housing ky first time home buyer rural development loan usda income limits rhs loan usda rural development loan usda rural housing

Kentucky USDA Mortgage Lender for Rural Housing Loans

What is a Kentucky USDA Rural home loan?

A Kentucky USDA home loan is a zero-dollar-down mortgage option provided by USDA’s Department of Rural Development.

This government-backed loan program comes in two types: direct loan, which is reserved for lower-income households and issued by USDA, and the guaranteed loan, which is reserved for low- to moderate-income families. The guaranteed loan is funded by private lenders, and USDA guarantees a portion of the loan against default.

Is a Kentucky USDA loan more beneficial than a Kentucky conventional loan?

The KY USDA home loan program is generally more beneficial to rural families than a conventional lending program, particularly for first-time homebuyers with lower- to median-level incomes.

Some of the benefits of Kentucky Rural Housing USDA loans include:

• zero down payment

• competitive interest rates

• lower-than-average monthly mortgage insurance

• relaxed credit requirements versus conventional loans

• no loan limits

How…

View original post 741 more words