Frequently Asked Questions Are only first-time homebuyers eligible? No, you do not have to be a first time home buyer. The USDA Loan program has no restrictions that prevent previous homeowners from using the program. What is the maximum amount that I can borrow? There isn’t a limit to the amount a homeowner can … Continue reading Kentucky USDA Rural Development Loans

Kentucky Rural Housing USDA Credit and Income Guidelines for 2018

Kentucky USDA Rural Housing Home Loans

In “Current USDA and RHS Guidelines”

Kentucky USDA Mortgage Lender for Rural Housing Loans

Kentucky Rural Housing USDA Credit and Income Guidelines for 2018

Kentucky Rural Housing USDA Credit and Income Guidelines for 2018

Kentucky Rural Housing USDA Credit and Income Guidelines for 2018 |

- No Down Payment required, 100% financing available

- 30 year fixed rate only no other terms allowed.

- Not limited to First Time Home buyers! Also available for the move up home buyer.

- More affordable than FHA when compared to mortgage insurance

- Seller concession fees at 6%

- No Bankruptcies last 3 years or foreclosures last 3 years

- Typical max income household income limits are centered on how many people are going to live in the home and which county you are going to buy a home in. Most Counties in Kentucky are maxed at $80k for a household of four or less, and up to $103k for a household of five or more.

- Debt to income ratios are usually centered around 45% on the backend ratio, meaning the new house payment plus the monthly bills…

View original post 468 more words

Kentucky FHA Appraisal Requirements For A Mortgage Loan Approval.

appraisal flipping, fha appraisals, property flipping fha, property flipping va, property usda flipping, rhs appraisals, usda appraisals.

Kentucky FHA Appraisal Requirements For A Mortgage Loan Approval.

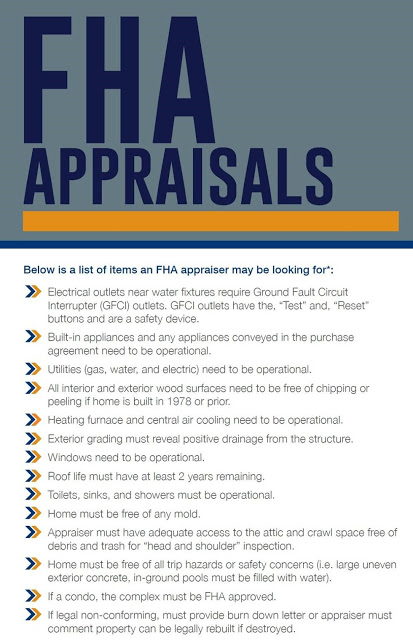

- Ordered through a third party source. Interested/vested parties may not initiate the appraisal. I.E> buyers, sellers, realtors, loan officer, family members

- Property must meet HUD’s minimum property standards. i.e.: permanent heat source, utilities must be on and in working order at time of inspection

- Flips < 90 days – not allowed Per HUD -If current owner owned less than 90 days FHA will not insure. Sometimes a second appraisal will be required by FHA investor if sold within the last 6 months for a large profit. Receipts of work done may be needed to substantiate increase in value of home in short-time period.

- Transferred appraisal – ok

- Appraisal valid 120 days – 30 day extension possible*

- Property eligibility – No location restrictions.

- New Construction Available

FHA MORTGAGE LOANS AND FLIPPING RULE FOR APPRAISALS

Resales Occurring 90 Days or Fewer after Acquisition:

View original post 422 more words

MORTGAGE LOAN PAYOFFS FOR USDA RURAL DEVELOPMENT DIRECT HOUSING LOANS IN KENTUCKY

MORTGAGE LOAN PAYOFFS FOR USDA RURAL DEVELOPMENT DIRECT HOUSING LOANS IN KENTUCKY

Kentucky USDA Mortgage Lender for Rural Housing Loans

View original post 2,711 more words

First Time Home Buyer Louisville Kentucky Mortgage Programs

First Time Home Buyer Louisville Kentucky Mortgage Programs