2018 kentucky va mortgage, Elizabethtown VA Loan, fort knox ky va mortgage, kentucky va loan, kentucky va loans, kentucky va mortgage, Kentucky VA refinance, louisville ky va home loan, louisville ky va mortgage, louisville streamline refinance va, VA Mortgage, va mortgage ky by Louisville Kentucky Mortgage.

Beshear: Nearly 550 Kentuckians Faced With Home Foreclosures Eligible for Payments

FRANKFORT, KY. – Attorney General Andy Beshear today announced nearly 550 Kentuckians who faced foreclosures on their homes from New Jersey-based PHH Mortgage Company are eligible fo... In Kentucky, 548 borrowers are eligible for a payment: A total of 300 who lost their property – 66 Kentuckians in 2009; 80 Kentuckians in 2010; 97 Kentuckians in … Continue reading Beshear: Nearly 550 Kentuckians Faced With Home Foreclosures Eligible for Payments

Does FHA require collections to be paid off for a borrower to be eligible for FHA financing?

Does FHA require collections to be paid off for a borrower to be eligible for FHA financing?

A Collection Account refers to a Borrower’s loan or debt that has been submitted to a collection agency by a creditor.

If the credit reports used in the analysis show cumulative outstanding collection account balances of $2,000 or greater, the lender must:

• verify that the debt is paid in full at the time of or prior to settlement using an acceptable source of funds;

• verify that the Borrower has made payment arrangements with the creditor and include the monthly payment in the Borrower’s Debt-to-Income ratio (DTI); or

• if a payment arrangement is not available, calculate the monthly payment using 5 percent of the outstanding balance of each collection and include the monthly payment in the Borrower’s DTI.

Collection accounts of a non-borrowing spouse in a community property state must be included in the $2,000 cumulative balance and analyzed as part of the Borrower’s ability to pay all collection accounts, unless excluded by state law. Unless the lender uses 5 percent of the outstanding balance, the lender must provide the following documentation:

• evidence of payment in full, if paid prior to settlement;

• the payoff statement, if paid at settlement; or

• the payment arrangement with creditor, if not paid prior to or at settlement.For manually underwritten loans, the lender must determine if collection accounts were a result of:

• the Borrower’s disregard for financial obligations;

• the Borrower’s inability to manage debt; or

• extenuating circumstances.The lender must document reasons for approving a mortgage when the Borrower has any collection accounts. The Borrower must provide a letter of explanation, which is supported by documentation, for each outstanding collection account. The explanation and supporting documentation must be consistent with other credit information in the file.

For additional information see Handbook 4000.1 II.A.4.b.iv.(M); II.A.5.a.iii.(D), II.A.5.a.iv.(O) at https://www.hud.gov/program_offices/administration/hudclips/handbooks/hsgh

Does FHA require collections to be paid off for a borrower to be eligible for FHA financing?

If the credit reports used in the analysis show cumulative outstanding collection account balances of $2,000 or greater, the lender must:

• verify that the debt is paid in full at the time of or prior to settlement using an acceptable source of funds;

• verify that the Borrower has made payment arrangements with the creditor and include the monthly payment in the Borrower’s Debt-to-Income ratio (DTI); or

• if a payment arrangement is not available, calculate the monthly payment using 5 percent of the outstanding balance of each collection and include the monthly payment in the Borrower’s DTI.

Collection accounts of a non-borrowing spouse in a community property state must be…

View original post 312 more words

Kentucky VA Home Loans Approval Criteria

KENTUCKY VA HOME LOANS APPROVAL CRITERIA Louisville Kentucky VA Home Loan Info Kentucky VA Mortgage Home Lender

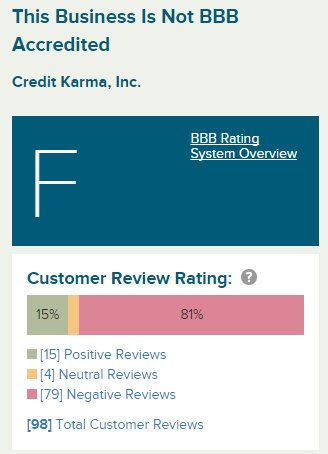

Credit Karma -“Free” isn’t good, and good isn’t free..

Credit Score First Time Home Buyer Louisville Kentucky

Louisville Kentucky Mortgage Loans

Credit Karma -“Free” isn’t good, and good isn’t free..

Almost every person I speak with about their credit, they monitor their scores through Credit Karma. It’s free, which is typically the reason why it’s used. But that old saying, good isn’t free..and free isn’t good comes to mind.

So I had the idea of checking in on Credit Karma’s rating and reviews on the Better Business Bureaus website. And here’s their rating…

I also pulled one of the reviews from the website…

“I recently used Credit Karma in Canada (where I live) to determine if I would be able to get a mortgage on a new home. My score from them show my credit to be well into the good category at 716. I then approached a company for a mortgage ( I would never have considered this with a bad score). I was contacted within a few hours that my…

View original post 500 more words