2 percent interest rate, fixed for 30 years., kentucky va, Kentucky VA Homes, kentucky va loans, kentucky va rates, Kentucky VA refinance, Kentucky Veterans, ky first time buyer, VA loan, va loans by Louisville Kentucky Mortgage

Kentucky Mortgage Underwriting Guidelines for a Loan Approval

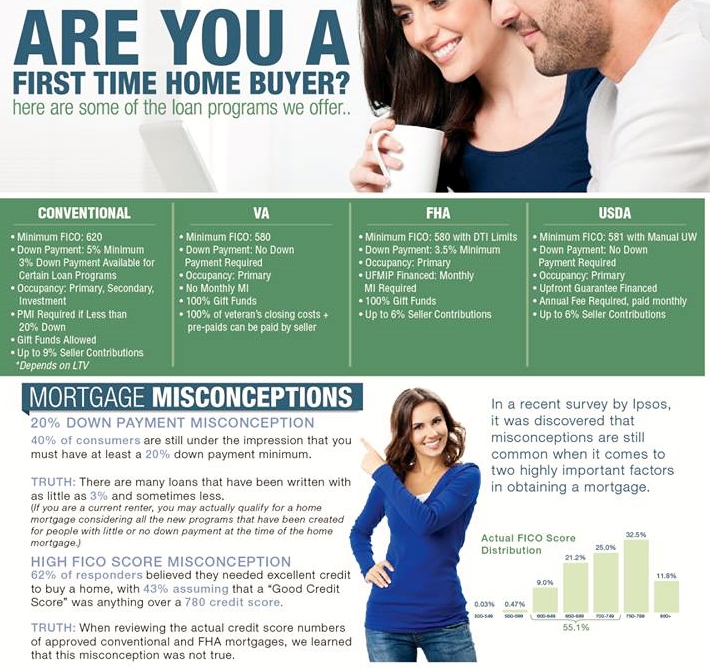

Kentucky FHA, VA ,USDA, KHC, Conventional and Jumbo mortgage loans

USDA financing

Loans In "Current USDA and RHS Guidelines" Kentucky USDA Guaranteed Rural Housing Mortgage Guidelines In "100% Financing Zero Down"

MortgageGirl Answers Frequently Asked Questions (Fall 2017)

BROKER VS. BANK / CLOSING COSTS / CREDIT / DEBTS / DOWNPAYMENT / FIRST TIME HOME BUYER / INCOME / LENDERS / MARKET UPDATES / MORTGAGE RULE CHANGES / PRE-APPROVALS / PURCHASE / QUALIFYING / RATES & TERMS / RULES /

Do you have mortgage questions? The MortgageGirl can answer today’s most commonly asked questions

Do you have mortgage questions? The MortgageGirl can answer today’s most commonly asked questions

How much does the “Bank” say I can afford?

For the answer, know your taxable income along with the amount of any debt outstanding along with the minimum monthly payments. Assuming it is your principal residence you are purchasing, calculate 35% of your income for use toward a mortgage payment, property taxes and heating costs. If applicable, half of the estimated monthly condominium maintenance fees will also be included. Make sure to include the one-time high ratio insurance premium onto the mortgage amount. Then, calculate 42-44% of your taxable income and deduct all monthly debt payments, including car loans, credit cards and lines of credit payments. The lesser of the first or second calculation will be used to help determine how much of your income can be used towards housing costs including your mortgage payment. ***…

View original post 470 more words

Kentucky First Time Home Buyer Programs for 2017

100% Financing, Zero Down Payment Kentucky Mortgage Home Loans for Kentucky First time Home Buyers