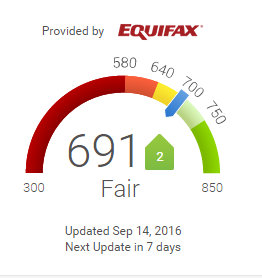

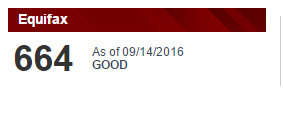

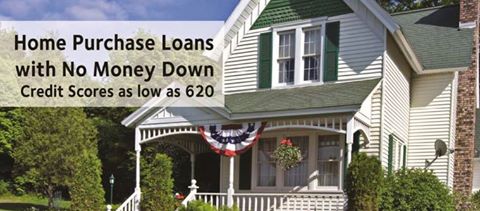

Credit Scores Needed To Qualify For A Kentucky Mortgage Loan Approval?

Share this:

- Share on LinkedIn (Opens in new window) LinkedIn

- Share on Tumblr (Opens in new window) Tumblr

- Share on X (Opens in new window) X

- Share on Reddit (Opens in new window) Reddit

- Email a link to a friend (Opens in new window) Email

- Share on Bluesky (Opens in new window) Bluesky

- Share on WhatsApp (Opens in new window) WhatsApp

- Share on X (Opens in new window) X

- Share on Threads (Opens in new window) Threads

- Print (Opens in new window) Print

- Share on Facebook (Opens in new window) Facebook

- Share on Pinterest (Opens in new window) Pinterest

- Share on Pocket (Opens in new window) Pocket

- Share on Telegram (Opens in new window) Telegram

- Share on Nextdoor (Opens in new window) Nextdoor

- Share on Mastodon (Opens in new window) Mastodon