What is the minimum credit score I need to qualify for a Kentucky mortgage currently? Question: What is the current minimum credit scores needed to qualify for a Kentucky mortgage Loan? Answer: The minimum credit score needed to qualify for a Kentucky mortgage depends on the type of loan program you are looking to obtain, this could … Continue reading Minimum Credit Scores for Kentucky Home Loans

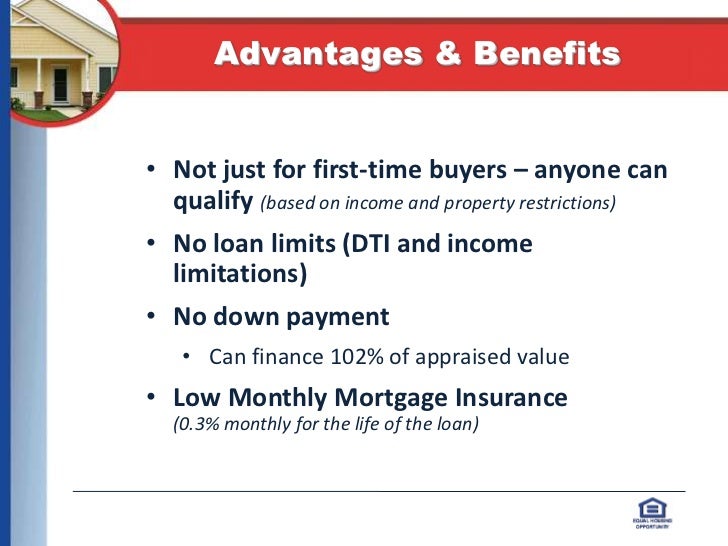

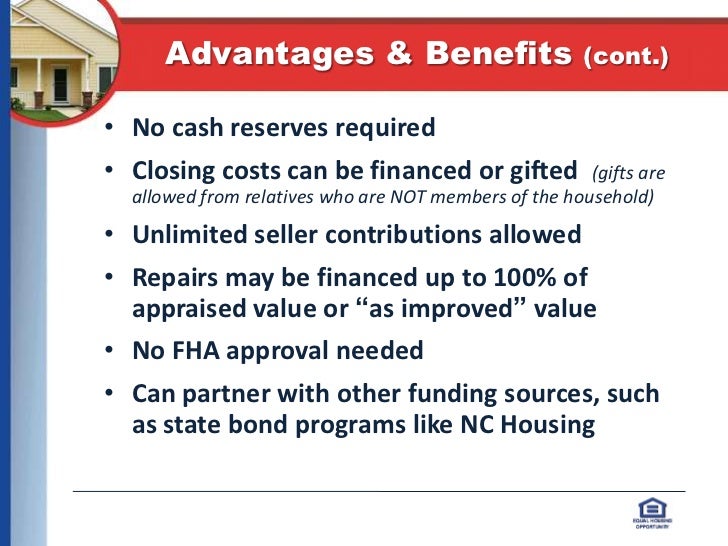

Kentucky Mortgage Broker Offering FHA, VA, USDA, Conventional, and KHC Down Payment Assistance Home Loans $100 Down FHA Mortgage, 100% Financing, 100% financing Kentucky Home Loan, approval tips, bad credit, Bankruptcy, charge offs, collections, Common Questions from Kentucky First-time Homebuyers, Credit Reports, credit score, Credit Scores, Debt to Income Ratio, Down Payment Assistance, Down Payment Assistance Programs in Kentucky, Fannie Mae, FHA, FHA Home Loans in Kentucky, FHA Loans Kentucky Housing First time home buyer, FHA/VA Louisville Kentucky, fico scores, First Time Home Buyer in Kentucky Zero Down, First Time Home Buyer Programs Louisville Kentucky, Grants, Home Buying And Down Payment Assistance Programs In Kentucky, Kentucky HUD Homes for $100 Down, Kentucky Rural Housing and USDA Credit Score Requirements, Kentucky USDA Loans, KHC Down payment Assistance Program Kentucky Housing, KHC Kentucky Housing, KHC Mortgage Interest Rates, Louisville First Time Buyer Mortgages, Louisville Kentucky First Time Home Buyer, Louisville Ky First Time Home Buyers, Manual Underwriting, Mortgage Insurance FHA, Mortgage Rates Currently, mortgage tips, QUICK GUIDE for Kentucky USDA Rural Development Housing Loan, rhs loans kentucky, Rural Deveoplment, rural housing, Rural Housing Loans No Money Down Program, Self-Employed, STUDENT LOANS, usda, VA, VA Loan, VA Loan REquirements for Kentucky, welcome home funds ky