Kentucky Mortgage Loan Credit Score Requirement. Loan Type Min. Credit Score Description Conventional 620 Most common Available from most lenders Requires private mortgage insurance (PMI) with less than 20% down FHA 500-10% down 580-3.5% down Can have lower credit scores, lower incomes, and/or higher debt Federal government guarantee and borrower-paid mortgage insurance allow lenders to … Continue reading What kind of credit score do I need to qualify for a Kentucky Mortgage Loan?

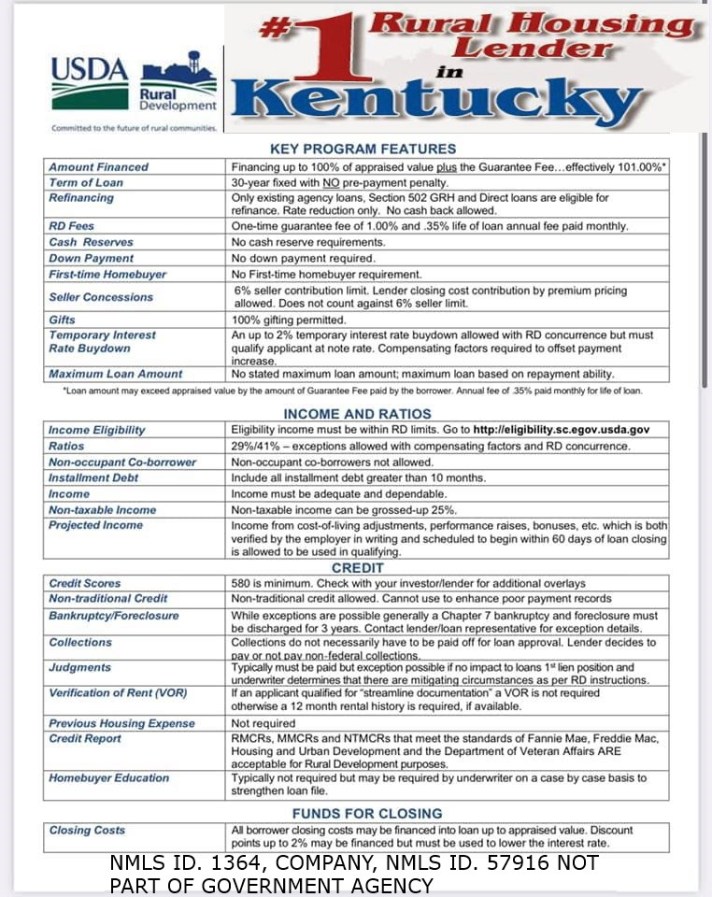

Kentucky Rural Housing Development Mortgage Guide for USDA Loans

Kentucky USDA Rural Housing Mortgage Lender

The USDA Rural Development Loan Program offers first time homebuyers and move-up buyers:

- 100% Financed Mortgage, No Money Down, $0 Down Payment

- USDA Loans monthly mortgage insurance premiums are 59% lower than a comparable FHA Loan

- Flexible Credit Requirements

- Safe, Secure 30 Year Fixed Rate Mortgage

- No Maximum Loan Amount

- With Seller Help, No Out-Of-Pocket Closing Costs

- Most Property Types Allowed

What is a debt to income ratio for a Kentucky Mortgage?

A debt to income ratio, commonly referred to as DTI, is the ratio of the amount of monthly expenses you have relative to your gross (before tax) income. The automated underwriter will look at two ratios when analyzing your DTI: your front end DTI ratio and your back end DTI ratio. Front End DTI … Continue reading What is a debt to income ratio for a Kentucky Mortgage?

FHA Changes for Mortgage Loans in Kentucky

Minimum Credit Scores for a Kentucky FHA loan. All Kentucky FHA loans will soon require a 500 credit score for all Kentucky Home buyers or homeowners looking to refinance who have a debt to income ratio over 55% percent. Kentucky FHA Loans with FICO scores under 620 will remain FHA-eligible, but you must show compensating … Continue reading FHA Changes for Mortgage Loans in Kentucky

How to Qualify For A Kentucky Mortgage Loan

Conventional loans follow guidelines set by government-sponsored enterprises Fannie Mae and Freddie Mac. FHA loans are insured by the Federal Housing Administration. VA loans are guaranteed by the U.S. Department of Veterans Affairs. USDA loans are backed by the U.S. Department of Agriculture to finance homes in USDA-eligible rural area